by Mark Morgenfruh | May 13, 2025 | Compensation Practices

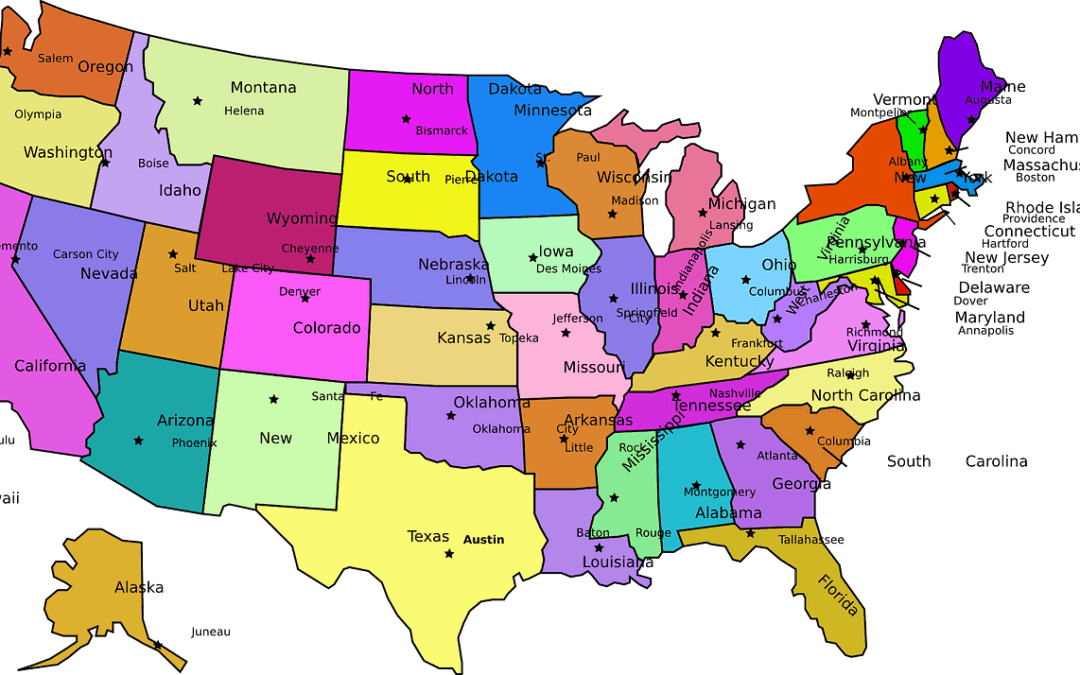

Do you have to offer relocation assistance to a new hire? A current employee? How do you handle an office or facility move? We help every business in America

Current Practices in Employee Relocation Compensation: A Strategic Approach to Mobility

In today’s dynamic business environment, employee relocation is more common than ever—driven by talent acquisition strategies, organizational expansion, restructuring, or the shift to hybrid and distributed workforces. Relocation compensation programs have evolved beyond simple reimbursements, becoming more strategic, data-informed, and employee-centric.

This article explores current trends and best practices in employee relocation compensation, with a focus on three distinct scenarios:

- A newly-hired employee who needs to relocate

- A current employee being relocated for business needs

- A relocation of an entire office or facility

Each of these scenarios presents different challenges, expectations, and compensation models.

- Relocation Compensation for a Newly-Hired Employee

Overview:

When a new hire is recruited from a different geographic location, employers often offer a relocation package to ease the transition and improve offer acceptance. These packages are especially common for executive roles, highly specialized talent, or hard-to-fill positions.

Common Components:

Relocation support for new hires typically includes:

- House-hunting trip(s): Paid travel and lodging to explore neighborhoods and housing options before moving.

- Moving expenses: Full or partial reimbursement of packing, shipping, and transportation of household goods.

- Temporary housing: Hotel or short-term housing for 30–90 days.

- Travel costs: One-way travel (airfare, car rental, gas, etc.) for the employee and family.

- Home sale or lease break assistance: Support for selling a home or covering lease termination fees.

- Relocation bonus or lump sum: A one-time payment to cover incidental costs.

- Tax gross-up: Additional payment to cover tax liabilities on relocation-related compensation.

Current Trends:

- Lump-Sum Payments: Many companies are moving to lump-sum relocation programs, which offer flexibility and reduce administrative burden. However, these require clear communication about what the lump sum is intended to cover.

- Tiered Programs: Employers often implement tiered relocation policies based on job level, location, or family status. Executive-level moves may receive more comprehensive support.

- Relocation Allowances as Negotiable: In competitive labor markets, relocation benefits are increasingly treated as a negotiable part of the offer package.

Key Considerations:

- Cost containment: HR must balance attracting talent with managing relocation costs.

- Candidate experience: A seamless relocation experience strengthens the employer brand.

- Tax implications: Since the 2018 Tax Cuts and Jobs Act in the U.S., most employer-paid moving expenses are taxable, unless the employee is military.

- Relocation Compensation for a Current Employee

Overview:

Internal relocations often occur due to promotions, lateral moves, talent development programs, or operational needs. These moves are different from new hire relocations because the employee is already embedded in the company, with a proven track record and existing benefits.

Common Components:

- Moving expenses and travel costs (similar to new hire relocations)

- Temporary housing and storage of household goods

- Spousal job support or career counseling

- Cost-of-living adjustments (COLA) if relocating to a significantly more expensive area

- Retention bonuses or relocation stipends

- Children’s education support, if the employee has school-aged dependents

- Repatriation clause for international assignments, guaranteeing a return to a similar role post-assignment

Current Trends:

- Personalized Relocation Services: Internal moves are increasingly supported by relocation counselors or outsourced providers who manage logistics, timelines, and family needs.

- Dual-Career Assistance: Companies are recognizing the importance of spousal or partner employment support, including job search help or access to networks.

- Talent Mobility as Strategy: Organizations are using relocation as a career development tool, offering international or cross-regional moves to high-potential employees as part of succession planning.

Key Considerations:

- Transparency: Clear communication about what is covered (and what isn’t) prevents misunderstandings.

- Employee Retention: Relocations should be framed as opportunities, not obligations.

- Support after the move: Ongoing support for integration into the new role, culture, and community is critical to success.

- Compensation in Office or Facility Relocations

Overview:

When an entire office or facility is relocated—whether due to consolidation, expansion, or cost reduction—it can affect dozens or hundreds of employees. HR must manage the financial, legal, and human impacts simultaneously.

Common Compensation Practices:

- Retention bonuses: Offered to key employees who commit to staying until or beyond the relocation date.

- Relocation packages: Provided to employees asked to move with the facility, including moving costs, housing support, and COLA.

- Severance packages: For employees who do not or cannot relocate.

- Commuter subsidies: For employees who choose to commute rather than relocate.

- Outplacement services: Career coaching and job search support for those affected.

Current Trends:

- Voluntary Relocation Pools: Companies often survey employees to gauge willingness to relocate, allowing for better planning and cost management.

- Remote Work Alternatives: In light of hybrid and remote work trends, some employers offer remote roles instead of relocation, reducing the number of required moves.

- Phased Relocation: Rolling transitions help avoid business disruption and allow employees more time to plan.

Key Considerations:

- Legal compliance: WARN Act and other labor regulations may apply depending on the number of employees affected.

- Internal communication: Transparent, empathetic communication about reasons, timelines, and support is critical.

- Employee morale: Even employees not directly affected may feel uncertain or disengaged during facility relocations.

Strategic Best Practices Across All Scenarios

- Policy Standardization with Flexibility:

- Use consistent frameworks (e.g., tiered policies) while allowing for some discretion in high-priority cases.

- Relocation Vendors and Technology:

- Many companies partner with relocation service providers and use platforms to manage logistics, track costs, and enhance the employee experience.

- Global Mobility Integration:

- For multinational companies, relocation policies are aligned with global mobility programs, addressing immigration, tax, cultural training, and family support.

- Measurement and ROI:

- HR teams are increasingly using metrics like retention post-relocation, employee satisfaction, and relocation spend vs. business impact to evaluate program effectiveness.

- Equity and Inclusion:

- Companies are auditing relocation programs for accessibility and fairness, ensuring diverse employees receive equitable support regardless of background or family structure.

Conclusion

Employee relocation compensation is no longer a one-size-fits-all solution. Today’s employers must offer tailored, competitive, and compliant relocation support across a range of scenarios—from new hires to internal moves and large-scale facility shifts.

At its best, a strategic relocation program:

- Enhances employer brand

- Enables talent mobility

- Minimizes disruption

- Supports employee well-being

As business models evolve, especially in the era of hybrid and global work, relocation programs must keep pace—grounded in strategy, empathy, and agility.

by Mark Morgenfruh | May 13, 2025 | Compensation Practices

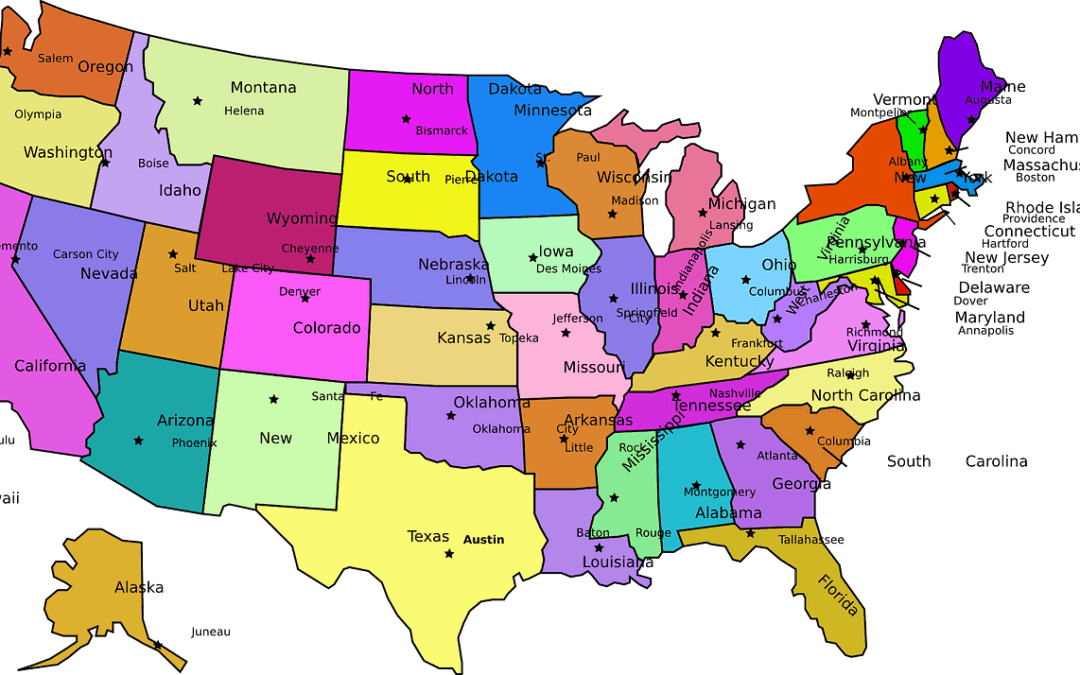

A cheeseburger in Manhattan, New York costs significantly more than one in Manhattan, Montana. Specialty skills are less likely to be widely available in rural areas. How do you know what to pay for a job in the geography where you operate? We help every business in America

Geographical Differentials in Compensation Practices

In today’s increasingly interconnected economy, compensation practices vary widely based on geography. Whether a business is managing employees across states, regions, or international borders, understanding geographical pay differentials is essential for maintaining equity, compliance, and competitiveness. Geographic location influences compensation due to differences in cost of living, labor supply and demand, regulatory environments, and market expectations. Companies that strategically apply these differentials can attract and retain talent while effectively managing labor costs.

What Are Geographical Pay Differentials?

Geographical pay differentials refer to adjustments in employee compensation based on the location where the work is performed. These adjustments account for variations in living costs, local wage norms, economic conditions, and industry competitiveness. For example, an entry-level marketing analyst in San Francisco may earn significantly more than a counterpart in Des Moines, Iowa, due to higher housing, transportation, and services costs in the Bay Area.

These differentials can apply to base pay, incentive pay, and even benefits. Organizations often use benchmark data from salary surveys and compensation databases to determine appropriate pay levels by location.

Key Drivers of Geographical Compensation Differences

- Cost of Living

One of the primary reasons for geographic pay variation is the cost of living. Employees in high-cost areas like New York City, San Francisco, or London face higher expenses for housing, groceries, transportation, and healthcare. To help maintain employee standards of living, employers often provide higher salaries in these locations. Cost-of-living indices and tools like the U.S. Bureau of Economic Analysis’s Regional Price Parities can guide these adjustments.

- Labor Market Conditions

Local labor market conditions influence compensation as well. High-demand skill sets or tight labor supply in a region can drive wages up. For example, tech hubs such as Seattle or Austin may command premium wages for software engineers due to intense competition among employers.

Conversely, areas with high unemployment or a surplus of talent may see lower wage growth, as the bargaining power of employees is reduced. Employers must stay attuned to labor market trends to remain competitive.

- Regional Business Costs

Operating costs for employers—like rent, utilities, and local taxes—can affect compensation decisions. In expensive urban centers, companies may increase compensation to retain employees who must cover their own increased living costs. Alternatively, companies may consider opening offices or hiring remotely in regions with more favorable cost structures.

- State and Local Laws

Minimum wage laws, overtime rules, pay equity regulations, and tax policies vary by jurisdiction. For instance, California’s minimum wage is higher than the federal minimum, requiring employers to comply with state-specific rules. Some cities, like Seattle and New York, also have their own pay transparency and wage floor laws. Employers must adjust pay practices to meet local legal standards while maintaining internal fairness.

- Remote and Hybrid Work Trends

The rise of remote work has added complexity to geographical compensation practices. Some companies, like Facebook and Google, have announced policies to adjust remote workers’ salaries based on their new locations, aligning pay with regional markets. Others have chosen to offer flat-rate compensation regardless of location, arguing that remote work is still equally valuable.

This evolving dynamic raises strategic questions: Should companies reward employees for moving to more affordable areas? Should pay reflect output rather than geography? The answers vary by company philosophy and talent strategy.

Strategic Approaches to Geographical Differentials

Organizations can choose from several models to manage geographic pay differences:

- National Pay Model: All employees are paid the same regardless of location. This is simpler to administer but may overpay in low-cost areas and underpay in high-cost ones.

- Local Market Pay Model: Compensation is aligned with local wage benchmarks. This is more precise but can introduce internal equity issues if employees in the same role are paid differently.

- Zone or Tiered Approach: Employees are grouped into geographic pay zones (e.g., Tier 1: major metros, Tier 2: suburbs, Tier 3: rural). This balances fairness with administrative efficiency.

- Custom Hybrid Models: Many employers combine elements, using national base pay with location-specific adjustments or stipends, especially for fully remote teams.

Challenges in Managing Pay Differentials

While strategic, geographic pay differentials come with risks:

- Perceived Inequity: Employees may feel undervalued if they earn less than peers in other regions for the same job.

- Communication Issues: Explaining pay differences requires clarity and transparency to maintain morale.

- Mobility Complications: When employees move—especially post-pandemic—companies must decide whether to adjust pay up or down, which can create friction.

- Regulatory Compliance: Staying current on wage laws across multiple jurisdictions can be resource-intensive.

Conclusion

Geographical differentials in compensation are an essential part of workforce strategy in today’s complex labor market. With rising mobility, remote work, and global expansion, businesses must balance cost control with talent competitiveness. The key is to build a fair, transparent, and data-driven approach that aligns pay with both external market realities and internal equity.

Ultimately, companies that thoughtfully manage geographic pay differences will be better positioned to attract, motivate, and retain top talent—no matter where that talent resides.

by Mark Morgenfruh | May 6, 2025 | Compensation Practices

After-hours alarms. Emergent situations requiring a worker be ready to respond. On-site or Off-site? When do I have to pay someone who is on call?

We help every business in America

On-Call Work and Compensation: What Employers Need to Know

In today’s dynamic workforce, many employers rely on on-call work arrangements to meet fluctuating demands, ensure 24/7 operations, and provide rapid responses to emergencies. This practice is common across industries such as healthcare, emergency services, utilities, IT, and hospitality. However, on-call work raises important questions about employee rights and employer obligations, especially regarding compensation.

This article explores the concept of on-call work, legal frameworks governing compensation for on-call time, factors influencing whether employers must pay employees during on-call periods, and best practices to navigate these challenges.

What is On-Call Work?

On-call work refers to situations where employees are required to be available to work outside of regular scheduled hours. Employees might stay at the workplace or remain reachable by phone or other communication means to respond if called upon. On-call arrangements are designed to provide employers with workforce flexibility while enabling prompt responses to business needs.

Types of On-Call Work

- On-site On-Call: Employees stay at or near the workplace, ready to perform duties immediately if needed.

- Off-site On-Call: Employees can be away from the workplace but must remain reachable and able to report to work within a reasonable timeframe.

Why Employers Use On-Call Work

- Operational Continuity: Critical in healthcare, utilities, emergency services where 24/7 coverage is essential.

- Cost Efficiency: On-call arrangements can reduce the need for full-time staffing during slow periods.

- Flexibility: Helps businesses quickly respond to fluctuating workload or emergencies.

- Compliance with Client Needs: Certain service contracts require rapid response times.

The Key Question: Must Employers Compensate On-Call Time?

The central issue employers and employees face is whether time spent on-call qualifies as compensable working time under labor laws, such as the Fair Labor Standards Act (FLSA) in the U.S., and applicable state laws.

U.S. Federal Law and On-Call Time

Under the Fair Labor Standards Act (FLSA), which governs minimum wage and overtime pay, whether on-call time is compensable depends on the degree to which the employee’s freedom is restricted during on-call periods. NOTE these only apply to hourly (non-exempt) workers as salaried (exempt) workers are not required to be paid extra for on-call work. Employers can choose to provide some sort of recognition or compensation to Exempt staff for on-call work, but it is not required under the law.

The Department of Labor’s (DOL) Guidance

The U.S. Department of Labor clarifies that:

- If an employee is required to remain on the employer’s premises or so close that they cannot use the time effectively for their own purposes, the on-call time must be compensated as hours worked.

- If an employee is merely required to leave word where they can be reached and can engage in personal activities while on call, then the on-call time is generally not compensable.

Key Considerations

- Location: Being on the employer’s premises or so close restricts the employee’s freedom.

- Restrictions on Activities: Limitations on what the employee can do during on-call time affect compensability.

- Response Time: Short response times usually imply more restrictions and more likelihood of compensable time.

- Frequency and Duration of Calls: Frequent interruptions convert on-call time into active working time.

Court Cases Highlighting On-Call Compensation Issues

Several court cases have helped clarify the compensability of on-call time:

- Skidmore v. Precision Printing and Packaging (1995): The court found that on-call employees required to stay on premises or nearby were entitled to pay.

- Anderson v. Mt. Clemens Pottery Co. (1946): Established that time spent waiting on premises or so close that employees cannot use it effectively for their own purposes is compensable.

- Lowe v. City of Peoria (2008): Ruled that off-site on-call time with restrictions could still be compensable if it significantly limits personal freedom.

These cases emphasize that the degree of control exercised by the employer over the employee’s time is the determining factor.

State Laws and On-Call Compensation

Many U.S. states have their own labor laws and interpretations that can be more protective than federal law.

- California: Generally, follows FLSA guidelines but often interprets restrictions on off-site on-call time more broadly, requiring compensation if the employee cannot effectively use the time freely.

- New York: Focuses on the degree of control and whether the employee’s ability to engage in personal activities is restricted.

- Massachusetts and Illinois: Some rulings have found on-call time compensable even if off-site, depending on the circumstances.

Employers must be aware of and comply with both federal and applicable state laws to avoid penalties and wage claims.

When is On-Call Time Compensable?

- On-Call Time On Employer’s Premises

Time spent on employer premises or required to remain so close that employees cannot use it for personal activities is compensable.

- On-Call Time Off Premises With Significant Restrictions

If off-site but subject to constraints such as short response times, no alcohol consumption, or limited mobility, on-call time may be compensable.

- On-Call Time Off Premises With No or Minimal Restrictions

If employees can use the time freely and only need to be reachable by phone or pager without other restrictions, time usually is not compensable.

- Time Spent Responding to Calls

Regardless of location, the actual time spent working after being called in is always compensable.

Practical Examples

- A nurse required to stay at the hospital on a call room during a shift’s off hours is paid for that time.

- A technician on call at home, required to respond within 30 minutes and not allowed to drink alcohol or leave a certain area, is not compensated unless engaged (and then, only if an hourly worker)

- A customer service rep who carries a pager and can do personal activities freely is not paid for on-call time but will be paid for actual work if they are an hourly worker.

Employer Best Practices for Managing On-Call Compensation

To reduce legal risks and maintain employee satisfaction, employers should:

- Clearly Define On-Call Policies

Set clear expectations on on-call duties, restrictions, response times, and compensation terms.

- Track Time Accurately

Use timekeeping systems that capture on-call hours where compensable, and record actual working time when called in.

- Communicate Transparently with Employees

Explain when on-call time is compensable and what behaviors or restrictions apply.

- Structure On-Call Pay Properly

Consider paying premiums, stipends, or guaranteed minimums for on-call shifts, even when not legally required, to promote fairness and retention.

- Monitor Changes in Laws

Labor laws evolve, so stay updated on federal and state regulations governing on-call pay.

The Pros and Cons of On-Call Pay for Employers

Advantages

- Employee Motivation and Satisfaction: Fair compensation encourages employees to accept on-call duties.

- Legal Compliance: Prevents wage claims and lawsuits.

- Retention and Recruitment: Competitive on-call pay attracts quality workers.

- Clear Cost Control: Budgeting for on-call pay avoids unexpected expenses.

Challenges

- Increased Labor Costs: Paying for on-call time can raise payroll expenses.

- Administrative Complexity: Tracking and managing on-call hours adds complexity.

- Potential Overuse: Employees may resist on-call assignments if poorly compensated.

Conclusion

On-call work is a necessary reality for many industries but presents challenges regarding fair compensation. Whether employers must pay for on-call time depends primarily on the degree of control and restrictions placed on employees during on-call periods, as defined by federal and state laws.

Employers who clearly understand these legal requirements and proactively develop transparent policies, accurately track time, and communicate openly with their workforce can effectively balance operational flexibility with compliance and employee fairness.

By recognizing when on-call time is compensable, employers protect themselves from costly legal risks and foster a workforce willing to support critical, around-the-clock business needs.

by Mark Morgenfruh | May 1, 2025 | Compensation Practices

What’s the right compensation model for your company? Is there more than one that is appropriate? We help every business in America

Understanding the Differences Between Piece Rate Pay and Productivity Pay in Compensation Practices

Compensation strategies are central to how organizations motivate their workforce, influence behavior, and achieve operational goals. Among the many pay structures available, Piece Rate Pay and Productivity Pay are two methods frequently used to incentivize employee performance, particularly in roles where output and efficiency are measurable.

Though they may seem similar at first glance because both relate pay to performance, Piece Rate Pay and Productivity Pay are distinct in design, application, and impact. This article explores these two compensation practices in depth, examining their definitions, key differences, advantages, disadvantages, and when to use each approach.

What is Piece Rate Pay?

Piece Rate Pay is a compensation system where employees are paid a fixed amount for each unit of work they complete or produce. This system directly links pay to output, creating a clear, straightforward incentive: the more pieces produced, the more money earned.

Key Characteristics of Piece Rate Pay:

- Payment per Unit: Workers receive a specific dollar amount per completed item or task.

- Direct Link to Output: Earnings increase proportionally with production volume.

- Common in Manufacturing & Agricultural Sectors: Widely used in industries where tasks are repetitive and output easily measurable.

- Individual Focus: Generally applies to individual workers rather than teams.

Example:

A factory worker assembling 10 widgets per day might earn $2 per widget, thus earning $20 for the day. If they assemble 15 widgets, their pay rises to $30.

What is Productivity Pay?

Productivity Pay is a broader compensation approach that rewards employees based on overall productivity, which can be measured in different ways beyond just unit output. Productivity might consider quality, efficiency, speed, and other performance metrics, not just quantity.

Key Characteristics of Productivity Pay:

- Payment Linked to Productivity Metrics: This could include output per hour, sales volume, quality ratings, or other key performance indicators (KPIs).

- Focus on Efficiency and Effectiveness: Encourages employees to not only produce more but also work smarter.

- Can be Individual or Group-Based: May be applied to teams or departments as well as individual workers.

- Flexible Measurement: Productivity can be measured in units produced, revenue generated, customer satisfaction scores, or cost savings.

Example:

A call center representative might receive a base salary plus bonuses based on the number of calls handled, customer satisfaction ratings, and average handling time. This combines quantity with quality for a holistic productivity measure.

Key Differences Between Piece Rate Pay and Productivity Pay

- Basis of Compensation

- Piece Rate Pay pays per unit produced or task completed.

- Productivity Pay pays based on overall productivity, which may incorporate multiple dimensions such as speed, quality, and efficiency.

- Scope of Measurement

- Piece Rate Pay focuses narrowly on output volume.

- Productivity Pay includes broader metrics, often combining quantity with quality and efficiency.

- Application Flexibility

- Piece Rate Pay is mostly used in manual, repetitive, and clearly measurable tasks.

- Productivity Pay can be adapted to a variety of job roles, including professional and service positions.

- Motivational Impact

- Piece Rate Pay strongly motivates employees to increase output.

- Productivity Pay encourages employees to balance output with other important factors like quality and cost-effectiveness.

- Risk and Fairness

- Piece Rate Pay may lead to a focus on quantity at the expense of quality or safety.

- Productivity Pay aims to reduce these risks by rewarding balanced performance.

Advantages of Piece Rate Pay

- Simple and Transparent

The direct correlation between work done and pay received is easy for employees to understand and manage.

- Strong Incentive for Output

Because pay is tied to units produced, employees are motivated to increase their production to boost earnings.

- Cost Control for Employers

Employers pay only for the work completed, which can help control labor costs and improve efficiency.

- Ease of Implementation

Particularly in manufacturing or piecework industries, piece rate systems are straightforward to implement.

Disadvantages of Piece Rate Pay

- Potential Quality Sacrifice

Employees might prioritize speed over quality, leading to defective products or poor service.

- Safety Concerns

The pressure to produce more can encourage unsafe work practices or lead to employee fatigue.

- Limited Application

Not suitable for complex or creative tasks where output isn’t easily quantifiable.

- Income Variability

Employees’ earnings may fluctuate widely, which can lead to dissatisfaction or financial insecurity.

Advantages of Productivity Pay

- Balanced Performance Incentive

Encourages employees to improve quality, efficiency, and other performance aspects, not just output.

- Applicable Across Various Roles

Can be tailored for roles in sales, customer service, professional services, and beyond.

- Supports Organizational Goals

By incorporating multiple performance metrics, productivity pay aligns employee efforts with broader company objectives.

- Team and Individual Incentives

Flexibility to reward both individual and group productivity fosters collaboration as well as individual accountability.

Disadvantages of Productivity Pay

- Complexity

Measuring productivity accurately requires sophisticated tracking systems and clearly defined metrics.

- Potential for Disputes

Employees may challenge how productivity is measured, especially if subjective criteria like quality or customer satisfaction are involved.

- Administrative Burden

Ongoing monitoring, data collection, and analysis can increase administrative costs.

- Risk of Misaligned Metrics

If poorly designed, productivity pay metrics can encourage undesired behaviors or fail to motivate employees effectively.

When to Use Piece Rate Pay

- Highly repetitive, standardized tasks: Assembly line work, agricultural picking, or data entry where units are uniform and easy to count.

- When volume of output is the key driver of business success: In industries where quantity directly affects revenue or operational goals.

- To control labor costs strictly tied to output: Employers only pay for work produced.

When to Use Productivity Pay

- Jobs with multiple performance dimensions: Roles where quality, speed, customer satisfaction, and efficiency all matter.

- Professional or service roles: Sales, call centers, consultants, or roles requiring a balance of different skills.

- Encouraging balanced behaviors: When employers want employees to focus on overall effectiveness rather than raw output.

- Team-oriented environments: Where collaboration and collective performance are essential.

Combining Piece Rate and Productivity Pay

Many organizations find value in blending these approaches. For example, an employee may receive piece rate pay for units produced, supplemented by a productivity bonus based on quality or customer satisfaction. This hybrid approach can mitigate some drawbacks of pure piece rate systems by rewarding well-rounded performance.

Conclusion

While Piece Rate Pay and Productivity Pay both tie compensation to performance, they serve different purposes and suit different types of jobs and business objectives. Piece Rate Pay offers a clear, straightforward incentive for increasing output, but can risk quality and safety. Productivity Pay, meanwhile, promotes a more balanced approach, rewarding employees for multiple aspects of their performance.

Understanding the nuances and implications of each system enables organizations to choose or design compensation plans that best align with their operational goals, workforce characteristics, and company culture. Often, a carefully structured combination of piece rate and productivity pay can deliver the most effective results — motivating employees, controlling costs, and driving sustainable business success.

by Mark Morgenfruh | Apr 22, 2025 | Compensation Practices

If Job Analysis is the first step to a compensation program, what’s the purpose of Job Evaluation? We help every business in America

Understanding Job Evaluation: Purpose and Process in a Structured Compensation Program

Designing a fair and competitive compensation system isn’t just about looking at what the market pays—it also involves understanding the internal value of jobs within an organization. This is where job evaluation plays a central role.

In the context of a structured compensation program, job evaluation is the mechanism that translates job content into relative value, allowing organizations to group jobs into levels, assign pay grades, and ensure internal equity.

This article explains:

- What job evaluation is

- Why it is essential for a compensation structure

- Common job evaluation methods

- The step-by-step process

- Best practices for sustainable implementation

What Is Job Evaluation?

Job evaluation is a systematic process used to determine the relative worth or value of jobs within an organization. It doesn’t assess the individual employee or their performance—it evaluates the job itself, based on factors like responsibilities, skills, complexity, and impact.

The primary output of job evaluation is:

- Job classification or leveling

- Pay grade assignment

- Internal equity alignment

By assigning relative value to jobs, job evaluation ensures that employees are paid fairly in comparison to others within the same organization, regardless of gender, tenure, or personal relationships.

Purpose of Job Evaluation in a Structured Compensation Program

A structured compensation system aims to provide consistency, equity, and market competitiveness. Job evaluation is essential because it helps:

- Ensure Internal Equity

Employees performing jobs of similar complexity and value should be compensated similarly. Job evaluation helps:

- Minimize favoritism

- Prevent pay compression

- Support defensible pay decisions

- Establish Job Hierarchies

By identifying the relative value of jobs, job evaluation creates a clear organizational hierarchy, which informs:

- Career pathing

- Succession planning

- Workforce architecture

- Support Compensation Structure Design

Job evaluation feeds directly into the development of:

- Salary bands and pay grades

- Compensation ranges

- Promotion and progression models

- Ensure Legal Compliance

A consistent, documented job evaluation process supports:

- Equal Pay Act compliance

- Defense against claims of discrimination or bias

- Alignment with pay transparency regulations

- Improve Communication and Transparency

Employees are more likely to trust the system when they understand how roles are evaluated and rewarded. This increases engagement, morale, and retention.

Common Job Evaluation Methods

Organizations can choose from several job evaluation methods depending on their size, complexity, and compensation philosophy:

- Point-Factor Method (Most Common)

- Breaks jobs into compensable factors (e.g., skill, effort, responsibility, working conditions)

- Assigns points to each factor based on level or intensity

- Total points determine the job’s value and grade

✅ Strengths: Highly detailed and objective

🔺 Drawbacks: Time-consuming to develop and maintain

- Job Classification / Grading

- Jobs are slotted into predefined classes or grades based on general descriptions of duties and responsibilities

- Often used in government and unionized environments

✅ Strengths: Simple and scalable

🔺 Drawbacks: Lacks precision for nuanced roles

- Factor Comparison

- Ranks jobs across several compensable factors and assigns monetary values to each factor

- Combines qualitative ranking and quantitative analysis

✅ Strengths: Balanced and detailed

🔺 Drawbacks: Complex and rarely used in modern systems

- Market Pricing

- Jobs are evaluated based on external market data

- Total compensation is based primarily on what other employers pay for similar roles

✅ Strengths: Fast and market-aligned

🔺 Drawbacks: Lacks internal consistency if job responsibilities vary

⚠️ Note: Many organizations use a hybrid approach, combining point-factor or classification methods with market pricing for external competitiveness.

Step-by-Step Job Evaluation Process

Step 1: Preparation and Planning

- Define the goals of the evaluation (e.g., restructure compensation, improve equity, integrate acquisitions)

- Choose the evaluation method best suited for the organization

- Gain buy-in from senior leadership and HR stakeholders

Step 2: Job Analysis (Input Stage)

- Collect accurate job data through:

- Job descriptions

- Questionnaires

- Manager and employee interviews

- Ensure all jobs are well-documented before evaluation begins

Step 3: Establish Compensable Factors

- Define which attributes will be used to evaluate job value. Common factors include:

- Skill (education, experience, technical knowledge)

- Effort (mental and physical demands)

- Responsibility (decision-making authority, budget impact)

- Working conditions (hazards, travel, stress)

Step 4: Evaluate and Score Jobs

- For point-factor systems, assign scores to each job for each factor

- Total the scores to determine the job’s overall value

- For classification systems, compare job descriptions to grade-level criteria and assign accordingly

Step 5: Assign Pay Grades or Levels

- Use the evaluation outcomes to group jobs into logical grades or levels

- Align each grade with a salary range based on internal equity and external benchmarks

Step 6: Review and Validate

- Conduct calibration sessions with department heads or HRBP teams

- Adjust for inconsistencies or disagreements

- Document rationale for decisions to support future audits or legal scrutiny

Step 7: Communicate and Implement

- Update internal systems with new job levels and grades

- Inform employees (as appropriate) about changes to job classification or pay structure

- Provide training for managers on how to use the new framework

Best Practices for Sustaining a Job Evaluation Program

- Keep Job Descriptions Current: Changes in job scope should trigger re-evaluation

- Audit Periodically: Reassess jobs every 1–3 years or when the organization undergoes major changes

- Integrate With Market Data: Maintain external competitiveness alongside internal consistency

- Ensure Stakeholder Involvement: Engage HR, department leaders, and compensation specialists

- Maintain Documentation: Keep clear records of evaluation decisions and methods for transparency and legal defense

Real-World Example

A national healthcare provider implemented a structured job evaluation system using the point-factor method. They evaluated 300 roles across clinical, administrative, and executive tracks. By recalibrating their grades and aligning them with both internal hierarchy and external benchmarks, they:

- Reduced turnover in nursing roles by 15%

- Eliminated 22 inconsistent titles

- Closed unexplained pay gaps by 9%

This helped them improve both cost control and workforce trust—proving the ROI of structured job evaluation.

Conclusion

Job evaluation is the engine that powers a structured and equitable compensation system. By translating job responsibilities into measurable value, organizations can create pay structures that reward work fairly, attract top talent, and promote internal consistency.

In a competitive and transparent labor market, the organizations that win will be those that pay thoughtfully—not just generously. Job evaluation ensures compensation decisions are based on fact, not favoritism—and that’s a win for both the business and its people.

by Mark Morgenfruh | Apr 13, 2025 | Compensation Practices

Please stop calling it a bonus! Short-term incentive plans are “incentives” to promote desired behaviors and performance to achieve business outcomes. A bonus makes it sound like an accidental extra not tied to anything. We help every business in America

Short Term Cash Incentive Plans in Compensation

In today’s competitive business environment, organizations strive to motivate employees, boost productivity, and align workforce efforts with strategic goals. One of the most effective compensation tools used to achieve these objectives is the Short-Term Cash Incentive Plan (STCIP). These plans provide employees with cash rewards based on their performance or the performance of the company over a relatively short period, typically within one year.

This article explores what short term cash incentive plans are, their benefits, how they are designed, common types, challenges, and best practices for implementation.

What Are Short Term Cash Incentive Plans?

Short Term Cash Incentive Plans are compensation programs that provide employees with additional cash payments as a reward for achieving specific performance targets within a short time frame, usually annually, quarterly, or monthly. These incentives are separate from base salary and often tied to individual, team, or organizational performance.

The “short term” aspect typically refers to incentive periods of less than 12 months, focusing on near-term goals that drive immediate business results.

Why Do Organizations Use Short Term Cash Incentive Plans?

- Motivating Immediate Performance

Short term cash incentives serve as powerful motivators by providing tangible, timely rewards linked directly to recent achievements. Employees are more likely to focus their efforts when they know that outstanding results will be rewarded quickly.

- Aligning Employee and Business Goals

By tying incentives to specific business objectives such as sales targets, cost reductions, or customer satisfaction scores, organizations ensure employees prioritize activities that support company strategy.

- Attracting and Retaining Talent

Competitive short term incentive plans can help attract top performers and reduce turnover by rewarding valuable contributions beyond fixed salaries.

- Providing Flexibility

Cash incentives offer flexibility compared to fixed salary increases, allowing companies to adjust rewards based on financial performance and changing business conditions.

Common Types of Short-Term Cash Incentive Plans

- Annual Incentive Plans

These are the most common form of STCIPs, where employees receive a cash Incentive at the end of the fiscal year based on performance metrics such as company profitability, departmental goals, or individual performance ratings.

- Sales Incentive Plans

Designed specifically for sales professionals, these plans reward meeting or exceeding sales quotas within a quarter or year. Incentives can be commissions, Incentives, or accelerators that increase payouts as targets are surpassed.

- Spot Incentives

Spot Incentives are one-time cash awards given to employees who demonstrate exceptional performance or contribution on a specific project or task. These are typically discretionary and given outside formal plan cycles.

- Project Completion Incentives

Employees involved in completing critical projects on time and within budget may receive cash incentives as a reward for their contribution.

- Team or Departmental Incentives

These plans distribute cash rewards based on the collective achievement of a team or department, encouraging collaboration and shared accountability.

Key Components in Designing Short Term Cash Incentive Plans

- Performance Metrics

Clear, measurable performance metrics are essential. These may include financial results (e.g., revenue growth, profit margins), operational targets (e.g., production efficiency, quality standards), or behavioral goals (e.g., customer service ratings).

- Eligibility and Participation

Organizations define which employees or groups are eligible—such as executives, sales teams, or all employees—and the criteria for participation.

- Incentive Payout Formula

This formula calculates the cash reward based on performance relative to targets. It may include thresholds (minimum performance for payout), target goals, and maximum payout caps.

- Frequency of Payout

Incentive payments can be made monthly, quarterly, or annually, depending on the nature of the business and the incentive objectives.

- Communication

Transparent communication about plan design, performance expectations, and payout potential is critical to ensure employee understanding and motivation.

Benefits of Short-Term Cash Incentive Plans

- Immediate Rewards Reinforce Desired Behavior

Cash rewards linked to recent performance create a direct connection between effort and payoff, reinforcing the behaviors the company wants to encourage.

- Flexibility in Rewarding Performance

STCIPs allow companies to reward high performance without committing to permanent salary increases, making it easier to manage compensation costs.

- Supports Goal Alignment

Linking incentives to specific, measurable business goals helps ensure that employee efforts drive company success.

- Enhances Employee Engagement

Employees who see clear recognition for their contributions are generally more engaged, motivated, and loyal.

Challenges of Short-Term Cash Incentive Plans

- Balancing Short-Term and Long-Term Focus

An overemphasis on short-term rewards may discourage employees from considering long-term business health or innovation.

- Design Complexity

Developing fair and effective plans that align with business goals and are perceived as equitable can be complex.

- Budget Management

Companies must carefully manage incentive budgets to avoid overpaying or under-rewarding, which can cause dissatisfaction.

- Potential for Unintended Behavior

If poorly designed, incentives might encourage gaming the system, cutting corners, or unhealthy competition among employees.

Best Practices for Implementing Short Term Cash Incentive Plans

- Align Incentives with Business Strategy

Ensure that the performance metrics directly support the company’s strategic objectives.

- Set Clear and Achievable Goals

Goals should be challenging but attainable to motivate without discouraging employees.

- Communicate Effectively

Regularly communicate plan details, progress updates, and results to maintain transparency and motivation.

- Integrate with Other Compensation Elements

STCIPs should complement base pay, benefits, and long-term incentives for a balanced total rewards package.

- Monitor and Adjust

Regularly review the plan’s effectiveness and make adjustments to metrics, payout structures, or eligibility to reflect changing business needs.

Conclusion

Short Term Cash Incentive Plans are a vital tool in modern compensation strategies, providing timely and flexible rewards that motivate employees and align their efforts with organizational goals. When carefully designed and implemented, these plans enhance performance, improve engagement, and help companies achieve both immediate and sustained success.

By balancing the drive for short-term results with long-term organizational health, businesses can leverage STCIPs to build a motivated workforce that contributes to ongoing growth and competitiveness.

![]()