by Mark Morgenfruh | Jun 22, 2025 | Compensation Practices

The devil is in the details. The finer points of a compensation program can have significant impact on attracting and retaining talent. If these are blind spots for you and you’re at risk of losing top talent if they are offered more money at a competitor, give us a call. We help every business in America

The Concept of Green Circles in Compensation Practices

In the field of compensation management, the term green circling refers to a situation where an employee’s salary falls below the minimum of the established pay range for their job or grade. This creates a “green circle” around the employee’s pay, indicating that their compensation is “below the range” for their position. While less commonly discussed than red circling (where pay exceeds the range), green circling is equally important and presents unique challenges and opportunities for employers.

Why Do Green Circles Occur?

Green circling typically occurs due to several factors:

- Salary Range Adjustments: When companies update their pay ranges to reflect market trends or internal restructuring, the minimum salary may increase, leaving some employees’ current pay below the new minimum.

- New Job Responsibilities or Promotions Without Immediate Pay Adjustment: An employee might have taken on additional responsibilities or been promoted without an immediate salary increase that aligns with the appropriate pay range.

- Internal Pay Compression: When new hires enter at salaries closer to or above the lower pay range minimum, existing employees might find their pay lagging behind, creating green circles.

- Inadequate Starting Salaries or Historical Underpayment: Some employees may have been hired or promoted at pay levels below market due to budget constraints or outdated compensation practices.

Implications of Green Circling

Employees who are green circled typically experience compensation that does not match the value of their work or their market worth, which can cause several issues:

- Low Employee Morale and Engagement: Being paid below the expected range may lead to dissatisfaction, decreased motivation, and disengagement.

- Retention Challenges: Employees who feel underpaid are more likely to seek employment elsewhere where their skills and experience are better compensated.

- Equity and Fairness Concerns: Other employees or new hires may earn more for similar roles or experience, which can cause resentment and perceptions of unfairness.

- Performance Impact: Compensation that doesn’t reflect an employee’s contribution can undermine efforts to promote a high-performance culture.

Managing Green Circles

Addressing green circled employees requires a strategic and sensitive approach:

- Salary Adjustments and Market Corrections

- The most direct approach is to raise the employee’s salary to at least the minimum of the pay range or closer to market levels.

- This helps align pay with job expectations, improving morale and retention.

- Phased Increases

- When budget constraints prevent immediate full adjustments, phased salary increases over time can bridge the gap.

- This approach communicates commitment to fair pay while managing financial impact.

- Performance-Based Increases

- Linking pay adjustments to demonstrated performance and skill development can justify salary increases and motivate employees.

- Review of Job Descriptions and Classifications

- Sometimes green circling is a symptom of misaligned job classifications. Reviewing and potentially reclassifying roles ensures pay ranges reflect actual duties and responsibilities.

- Transparency and Communication

- Explaining compensation decisions and providing career development opportunities helps employees understand their path to fair pay.

Benefits of Addressing Green Circles

Effectively managing green circled salaries benefits both employees and organizations:

- Improved Employee Satisfaction: Fair compensation signals that the company values employees, boosting morale and loyalty.

- Enhanced Retention: Competitive pay reduces turnover and the costs associated with hiring and training replacements.

- Stronger Employer Brand: Companies known for fair and competitive pay attract higher-quality candidates.

- Increased Productivity: Employees who feel valued are more likely to be engaged and contribute positively.

Conclusion

Green circling is a critical consideration in compensation management. It highlights situations where employee pay falls below market or internal standards, signaling a need for review and adjustment. Ignoring green circling can result in decreased morale, retention problems, and challenges to building a fair and motivating workplace.

By proactively addressing green circles with thoughtful pay adjustments, communication, and alignment of job roles, employers can strengthen their compensation programs and foster a positive organizational culture. Ensuring that employee pay fairly reflects their contributions and market value is essential for maintaining a motivated, engaged, and productive workforce.

by Mark Morgenfruh | Jun 3, 2025 | Compensation Practices

How are you rewarding your people as they upskill? Are you struggling with employees getting training on their own, outside a professional development plan, and then expecting more pay, a promotion, or both? We help every business in America

Compensation Practices of Promotions, Demotions, Degree Attainment, and Obtaining Licenses and Certifications

In the complex world of human resources and compensation management, organizations continuously seek effective methods to reward employees, maintain internal equity, motivate skill development, and align pay with evolving job roles and employee qualifications. Among the various compensation practices, those tied to promotions, demotions, degree attainment, and obtaining professional licenses or certifications play pivotal roles in shaping workforce behavior and organizational success.

This article examines each of these compensation practices in detail, discussing their rationale, common implementation methods, benefits, and challenges.

- Compensation Practices Related to Promotions

Understanding Promotions in Compensation

A promotion typically involves elevating an employee to a higher-level job with increased responsibilities, scope, and often complexity. From a compensation perspective, promotions generally require adjustments to base pay and other rewards to reflect the higher value of the new position.

Why Compensation Adjustments Are Necessary

- Align Pay with Job Responsibilities: The promoted role demands more skills, accountability, and decision-making power, warranting higher compensation.

- Motivate and Reward Employees: A promotion pay raise recognizes employee achievement and incentivizes continued growth.

- Maintain Internal Equity: Pay must be adjusted to maintain fairness relative to peers in similar roles.

Typical Compensation Approaches for Promotions

- Fixed Percentage Increase: Employers often apply a flat percentage raise (e.g., 7-15%) upon promotion.

- Adjustment to Pay Range Minimum or Midpoint: Promoted employees may receive pay that aligns with the new job’s pay range, often moving them to at least the minimum or midpoint.

- Market-Based Adjustments: Compensation specialists might benchmark market rates for the promoted role to determine appropriate pay.

- One-Time Lump Sum: In some cases, a one-time bonus supplements base pay increases for a promotion.

Considerations and Challenges

- Pay Compression: Promotions may result in minimal pay increase if the promoted employee’s new pay is too close to peers or subordinates.

- Internal Equity: Organizations must ensure promotion raises don’t disrupt established pay relationships.

- Budget Constraints: Limited compensation budgets may restrict promotional pay increases.

- Communication: Transparency around promotion and pay policies is vital to maintain morale.

- Compensation Practices Related to Demotions

Understanding Demotions in Compensation

A demotion occurs when an employee moves to a lower-level position, either voluntarily or involuntarily. It may result from performance issues, restructuring, or employee choice. Compensation adjustments typically accompany demotions to reflect the lower responsibilities and job value.

Why Adjust Pay for Demotions

- Align Pay with New Role: The demoted position generally requires fewer skills or less responsibility.

- Maintain Internal Equity: Pay should be consistent with others in the lower-level role.

- Signal Organizational Standards: Salary reduction reinforces accountability and the consequences of performance.

Common Compensation Strategies for Demotions

- Salary Reduction: Employers reduce base pay to align with the new role’s pay range, often by a specific percentage or to the new minimum.

- Freeze on Pay: Sometimes, organizations maintain current pay temporarily but freeze raises until pay aligns with the lower position.

- No Reduction: In rare cases, demoted employees keep their pay, creating a “red circle” situation (where pay exceeds the range maximum).

- Severance or Transition Pay: In involuntary demotions due to restructuring, companies may offer severance or temporary pay supplements.

Challenges and Considerations

- Employee Morale: Demotions and pay cuts can severely affect morale and engagement.

- Legal Risks: Demotions must be managed carefully to avoid discrimination claims or breach of contract.

- Retention Issues: Employees may leave after demotion unless supported well.

- Communication and Support: Clear, empathetic communication and transition assistance are critical.

- Compensation Practices Related to Degree Attainment

Why Organizations Reward Degree Attainment

In today’s knowledge-driven economy, formal education, such as earning a college degree, often correlates with enhanced skills, knowledge, and productivity. Organizations use compensation incentives to:

- Encourage Employee Development: Supporting education improves workforce capabilities.

- Attract and Retain Talent: Educational rewards demonstrate investment in employees.

- Align Pay with Qualifications: Degrees can signify readiness for advanced roles.

Typical Compensation Practices for Degree Attainment

- Educational Pay Differentials: Organizations add fixed pay increases (e.g., $50-$200/month) or lump sums for employees who earn certain degrees.

- Step Increases: Employees may move to higher pay steps within their grade after earning a degree.

- Promotional Consideration: Degree attainment can qualify employees for promotions and associated pay increases.

- Tuition Reimbursement Programs: While not a direct raise, tuition assistance incentivizes degree completion and often leads to pay adjustments.

Types of Degrees Often Rewarded

- Associate, Bachelor’s, and Master’s Degrees: Higher degrees usually receive higher pay differentials.

- Job-Relevant Degrees: Education closely aligned with the employee’s role or industry is often prioritized.

- Advanced Certifications and Professional Degrees: In some fields, degrees such as law or medicine trigger significant pay adjustments.

Benefits and Challenges

- Benefits:

- Enhances organizational capability and competitiveness.

- Signals a commitment to employee growth.

- Can lead to improved retention and morale.

- Challenges:

- Determining pay differentials that fairly reflect degree value.

- Managing pay equity when some employees have degrees and others don’t.

- Verifying educational credentials and ensuring relevance to the job.

- Compensation Practices Related to Obtaining Licenses and Certifications

The Role of Licenses and Certifications in Compensation

Licenses and certifications demonstrate that employees have met industry standards or regulatory requirements and possess specific technical or professional skills. Employers recognize these achievements as enhancing job performance and compliance.

Why Employers Reward Licenses and Certifications

- Compliance and Risk Management: Many roles legally require licenses to perform essential functions.

- Quality Assurance: Certified employees often deliver higher quality work.

- Skill Development: Certifications represent ongoing professional growth.

- Competitive Advantage: Certified employees increase organizational reputation and capability.

Common Compensation Methods for Licenses and Certifications

- Certification Pay Differentials: Fixed monthly or annual increases for holding certain licenses or certifications.

- Lump-Sum Bonuses: One-time payments when employees obtain or renew certifications.

- Pay Range Adjustments: Certifications may qualify employees for higher pay grades or salary ranges.

- Reimbursement Programs: Organizations often reimburse costs associated with obtaining and maintaining licenses and certifications.

Examples of Certifications Commonly Rewarded

- IT Certifications: Such as Cisco Certified Network Associate (CCNA), Certified Information Systems Security Professional (CISSP).

- Healthcare Licenses: Registered Nurse (RN), Licensed Practical Nurse (LPN), Certified Medical Assistant.

- Financial Certifications: Certified Public Accountant (CPA), Chartered Financial Analyst (CFA).

- Project Management: Project Management Professional (PMP).

Benefits and Challenges

- Benefits:

- Improves workforce qualifications and operational quality.

- Encourages continuous professional development.

- Supports compliance with regulatory requirements.

- Challenges:

- Keeping pace with new certifications and relevance.

- Avoiding inequities if certifications are not equally accessible.

- Determining appropriate pay premiums.

Integrating These Compensation Practices into a Holistic Strategy

Organizations that strategically link compensation to promotions, demotions, degree attainment, and licenses/certifications benefit in multiple ways:

- Talent Development and Retention: Offering clear financial rewards for advancement, education, and certification encourages employees to grow with the company.

- Internal Equity and External Competitiveness: Adjusting pay appropriately maintains fairness and aligns compensation with market standards.

- Regulatory Compliance and Risk Management: Licenses and certifications ensure employees meet legal and industry standards.

- Performance and Motivation: Compensation tied to these milestones signals value and motivates continued effort.

To succeed, companies should:

- Define Clear Policies: Set transparent guidelines for pay adjustments linked to promotions, demotions, education, and certifications.

- Use Market Data: Benchmark pay practices to ensure competitiveness and equity.

- Communicate Transparently: Explain how compensation changes relate to employee achievements.

- Regularly Review Practices: Update policies to reflect market changes, regulatory requirements, and organizational goals.

Conclusion

Compensation practices tied to promotions, demotions, degree attainment, and licenses/certifications form essential components of a comprehensive compensation system. These mechanisms help align employee pay with their evolving roles, qualifications, and contributions while promoting fairness, motivation, and compliance.

By thoughtfully implementing and managing these compensation adjustments, organizations can create a dynamic workplace culture where employees are encouraged to grow, perform, and stay engaged—ultimately driving organizational success.

by Mark Morgenfruh | May 30, 2025 | Compensation Practices

How do you tie Executive Compensation to value generation WITHOUT diluting share value? We help every business in America

Long Term Synthetic Equity Incentive Plans in Compensation

In today’s dynamic and competitive business landscape, companies seek innovative ways to motivate and retain top talent, especially key executives and high-potential employees. While traditional equity plans such as stock options and restricted stock units have long been a staple, many organizations are increasingly turning to Long Term Synthetic Equity Incentive Plans (LTEIPs). These plans offer many of the motivational and alignment benefits of actual equity ownership, but without granting real stock or diluting ownership.

This article explains what Long Term Synthetic Equity Incentive Plans are, how they work, their benefits, challenges, and best practices for implementation.

What Are Long Term Synthetic Equity Incentive Plans?

Long Term Synthetic Equity Incentive Plans are compensation arrangements that mimic the economic benefits and incentives of actual stock ownership, but without employees receiving real company shares. Instead, employees receive rights or units whose value is tied to the company’s stock price or other performance metrics.

Because synthetic equity does not involve issuing actual stock, it avoids shareholder dilution and some of the regulatory and accounting complexities that accompany real equity awards. Typically, synthetic equity awards vest over several years and are paid out in cash or stock equivalents based on the company’s performance.

How Do Synthetic Equity Plans Work?

Synthetic equity plans generally come in a few common forms:

- Phantom Stock

Phantom stock grants employees a contractual right to receive a cash payment or stock equivalent equal to the value of a certain number of company shares at a future date. Phantom stock typically vests over a multi-year period, and the payout reflects the appreciation of the company’s stock price, including dividends in some cases.

- Stock Appreciation Rights (SARs)

SARs give employees the right to receive a cash or stock bonus equal to the increase in the company’s stock price over a set period. Unlike phantom stock, SARs typically do not include the base value of the shares—only the appreciation is rewarded.

- Performance Units

Performance units are synthetic equity tied to the achievement of specific performance goals. When the performance period ends, the units convert into cash or shares based on how well the company met the targets.

Why Companies Use Long Term Synthetic Equity Incentive Plans

- Avoiding Shareholder Dilution

Because no actual shares are issued, synthetic equity awards do not dilute existing shareholders’ ownership stakes, making them attractive to privately held companies and startups concerned about equity distribution.

- Simplified Administration

Synthetic plans often avoid the complexity of stock issuance, transfer restrictions, and securities regulations, simplifying administration and reducing legal costs.

- Alignment with Company Performance

Like real equity, synthetic equity aligns employee rewards with company performance by basing payouts on stock price appreciation or other business metrics.

- Retention Through Vesting

Synthetic equity awards typically vest over several years, encouraging employees to stay with the company long term.

- Flexibility in Payout

Since payouts are often made in cash, companies can structure the timing and amount of payments to balance cash flow with employee incentives.

Benefits of Long-Term Synthetic Equity Incentive Plans

- Motivation and Engagement

Synthetic equity offers employees the chance to share in the company’s success, boosting motivation and engagement without the complexities of real ownership.

- Retaining Key Talent

The vesting schedules inherent in synthetic plans help retain valuable employees by incentivizing them to stay for the long haul.

- No Equity Ownership Transfer

Since no actual stock is transferred, companies retain full ownership control, which is especially important for family businesses or closely held firms.

- Customizable Performance Metrics

Companies can tie synthetic equity payouts to a wide range of metrics beyond stock price, such as revenue growth, EBITDA, or other operational goals.

- Easier Tax Treatment

While still taxable, synthetic equity often has simpler tax implications than actual stock awards, though specifics depend on jurisdiction.

Challenges and Considerations

- Cash Flow Impact

Because synthetic equity is usually paid out in cash, companies must plan for potential significant cash obligations at payout times.

- Employee Perception

Some employees may perceive synthetic equity as less valuable or less prestigious than real stock ownership, which could impact motivation.

- Plan Design Complexity

While simpler than real equity plans, synthetic equity plans still require careful design to align incentives and comply with tax and legal requirements.

- Accounting Requirements

Companies must properly account for synthetic equity liabilities on their financial statements, which can affect reported earnings.

Best Practices for Implementing Synthetic Equity Plans

- Clear Communication

Ensure employees fully understand how synthetic equity works, its value proposition, and payout mechanics to maximize engagement.

- Align with Business Goals

Design plan performance metrics and vesting schedules to support the company’s strategic objectives and financial capabilities.

- Plan for Cash Flow

Anticipate and budget for cash payouts, especially during periods when multiple awards vest simultaneously.

- Consult Legal and Tax Experts

Work closely with legal and tax professionals to design compliant plans that optimize tax treatment for both company and employees.

- Regular Review and Adjustment

Review plan effectiveness regularly and make adjustments to maintain alignment with business needs and market practices.

Conclusion

Long Term Synthetic Equity Incentive Plans offer companies a powerful way to motivate and retain key talent while avoiding some of the complexities and downsides of traditional equity compensation. By providing employees with rewards tied to company performance without diluting ownership, synthetic equity strikes a balance between incentive and control.

When thoughtfully designed and communicated, these plans foster a strong sense of ownership and long-term commitment, driving sustained business success. Companies considering equity incentives but hesitant to issue actual shares should explore synthetic equity as a flexible, effective alternative.

by Mark Morgenfruh | May 25, 2025 | Compensation Practices

How do you design a balanced compensation structure that fits your organization, promotes career mobility, rewards performance and longevity and doesn’t promote red-circle conditions too quickly? We help every business in America

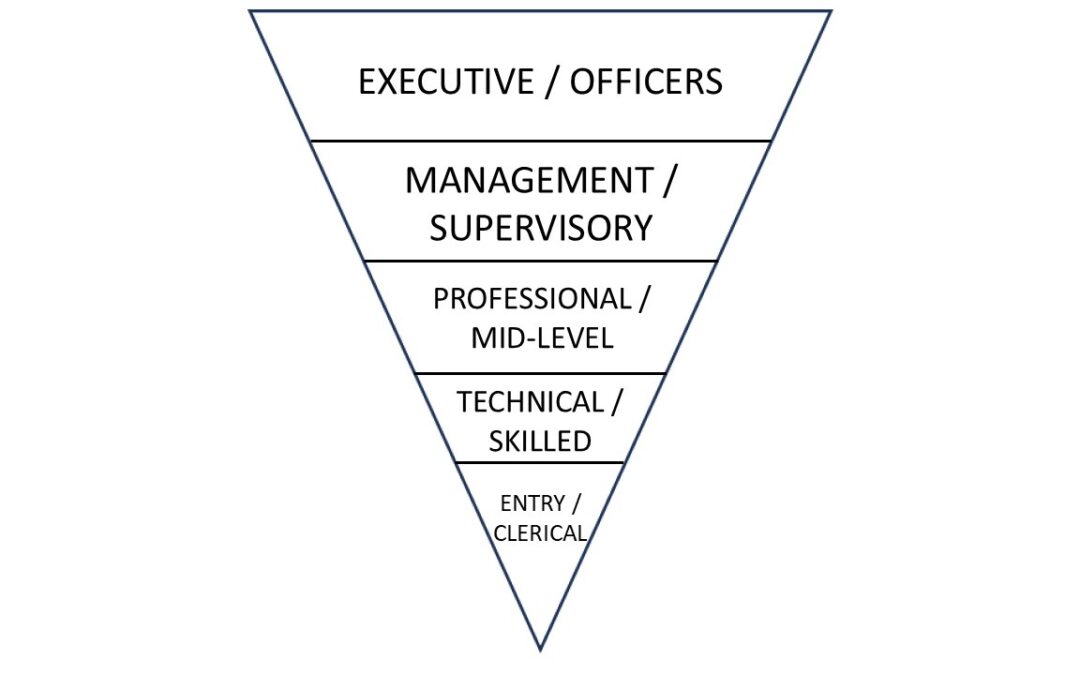

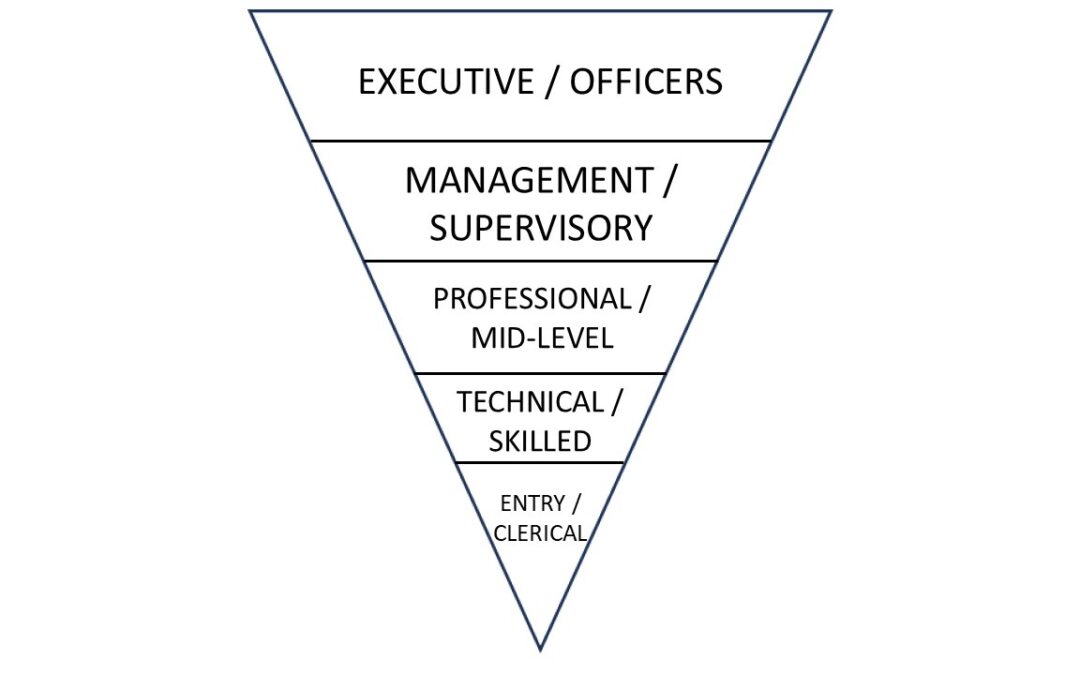

Understanding the Inverted Pyramid of Compensation Range Spread

Designing a fair, motivating, and strategic compensation system requires more than simply setting salaries—it involves carefully structuring pay ranges across different job levels. One common framework used in compensation design is the inverted pyramid model of compensation range spread.

In this article, we’ll explore:

- What compensation range spread is

- How the inverted pyramid model works

- Why lower pay grades have narrower ranges

- Why executive and officer pay grades have wider ranges

- How this structure supports career progression and organizational strategy

What Is Compensation Range Spread?

Compensation range spread refers to the difference between the minimum and maximum of a salary range for a given job grade or level. It is typically expressed as a percentage:

Range Spread % =

(MaximumSalary – MinimumSalary) ÷ MinimumSalary × 100

For example:

- A range with a minimum of $50,000 and a maximum of $65,000 has a spread of 30%.

- A range with a minimum of $150,000 and a maximum of $240,000 has a spread of 60%.

Why Lower Pay Grades Have Narrower Ranges

At the bottom of the inverted pyramid—where entry-level and frontline jobs exist—compensation ranges are typically narrow, often between 20% and 40%.

Reasons:

- Faster Role Progression

Employees in early-career or operational roles are expected to develop quickly and move up into new roles as they gain skills. A narrow range encourages this progression by limiting the potential for long-term salary growth in a single role.

🔹 Example: A customer service representative may start at $40,000 and cap at $50,000, prompting them to seek promotion into a team lead or supervisor role.

- Market Uniformity

Entry-level positions are more easily benchmarked and commoditized across companies, resulting in tighter market ranges. There’s less variation in duties, making external data more standardized.

- Cost Control

Wider ranges at lower levels could result in disproportionate salary increases for positions that don’t have increased responsibilities or market demand.

Why Executive and Officer Pay Grades Have Wider Ranges

At the top of the inverted pyramid—where senior executives, officers, and specialized experts reside—compensation ranges are much wider, often 60% to 100% or more.

Reasons:

- Longer Tenure in Roles

Executives tend to stay in their roles longer. A wider range allows for sustained growth within a single role, recognizing both performance and loyalty over time.

🔹 Example: A VP of Sales may remain in role for 10+ years and receive merit increases, bonuses, or equity awards without changing job titles.

- Performance-Based Differentiation

At senior levels, compensation is heavily tied to results, strategic impact, and company performance. Wider ranges allow for variable pay based on individual and organizational outcomes.

- Talent Retention and Negotiation Flexibility

Executives are often hired in competitive environments where pay flexibility is essential. A wide range accommodates negotiations and custom offers based on skills, experience, and prior compensation.

- Equity and Long-Term Incentives

Compensation at the top often includes stock options, deferred compensation, or profit-sharing, all of which contribute to wider total compensation variability.

Typical Range Spread Benchmarks by Level

| Job Level |

Typical Range Spread |

| Entry-Level / Clerical |

20% – 30% |

| Technical / Skilled Roles |

30% – 40% |

| Professional / Mid-Level |

40% – 50% |

| Management / Supervisory |

50% – 60% |

| Executive / Officers |

60% – 100%+ |

by Mark Morgenfruh | May 23, 2025 | Compensation Practices

How do you tie Executive Compensation to value generation with the greatest motivational force? We help every business in America

Long Term Equity Incentive Plans in Compensation

In today’s competitive business environment, attracting, motivating, and retaining top talent is crucial for organizational success. One of the most powerful tools companies use to achieve these goals is Long Term Equity Incentive Plans (LTEIPs). These plans align the interests of employees, particularly executives and key contributors, with those of shareholders by offering ownership stakes in the company. By doing so, LTEIPs encourage employees to focus on long-term value creation rather than just short-term results.

This article explores what Long Term Equity Incentive Plans are, their importance, common types, benefits, challenges, and best practices for implementation.

What Are Long Term Equity Incentive Plans?

Long Term Equity Incentive Plans are compensation programs that grant employees equity-based awards that typically vest over multiple years. These awards provide employees with an opportunity to own shares or share equivalents in the company. Unlike cash bonuses or salary increases, equity incentives are tied to the company’s stock performance and often require employees to remain with the company over a longer period before they can fully realize their value.

LTEIPs are primarily designed to reward long-term performance, encourage retention, and foster a sense of ownership among key employees.

Why Are Long Term Equity Incentive Plans Important?

- Aligning Employee and Shareholder Interests

By granting equity, companies create a direct link between employee compensation and shareholder value. Employees benefit financially when the company’s stock price increases, motivating them to contribute to sustained growth and profitability.

- Attracting and Retaining Top Talent

Equity incentives are especially attractive to high-caliber candidates and critical employees who seek to participate in the company’s future success. The vesting schedules encourage retention, as employees typically need to stay several years to fully benefit from their awards.

- Encouraging Long-Term Focus

Unlike short-term bonuses that reward immediate results, LTEIPs encourage employees to focus on strategic decisions and actions that promote lasting value.

- Cash Conservation

For startups or rapidly growing companies with limited cash resources, equity incentives offer a way to reward employees without impacting cash flow.

Common Types of Long Term Equity Incentives

- Stock Options

Stock options give employees the right to purchase company shares at a predetermined price (exercise price) after a vesting period. If the market price exceeds the exercise price, employees can buy shares at a discount, benefiting from the difference. Options encourage employees to work toward increasing stock value.

- Restricted Stock Units (RSUs)

RSUs are promises to deliver shares once certain conditions, such as time-based vesting or performance goals, are met. Unlike options, RSUs have intrinsic value upon vesting, as employees receive actual shares.

- Performance Shares

Performance shares are equity awards granted only if the company meets specified performance metrics over a multi-year period, such as earnings per share growth or total shareholder return. They link rewards directly to business results.

- Stock Appreciation Rights (SARs)

SARs provide employees with a cash or stock bonus equal to the increase in the company’s stock price over a set period, without requiring employees to purchase shares.

Benefits of Long Term Equity Incentive Plans

- Promotes Employee Ownership Mentality

Equity awards encourage employees to think like owners, aligning their daily decisions with the company’s long-term success.

- Enhances Retention

Vesting schedules typically require employees to stay several years to realize full benefits, reducing turnover among key talent.

- Drives Performance

Performance-based equity awards motivate employees to achieve specific business goals that enhance shareholder value.

- Attracts High-Quality Talent

Offering equity stakes can be a compelling component of total compensation, particularly in competitive industries like technology and finance.

- Balances Cash Compensation

Equity incentives allow companies to conserve cash while still offering competitive rewards, important for startups or companies in growth phases.

Challenges in Long Term Equity Incentive Plans

- Complexity and Communication

Equity compensation can be complex for employees to understand. Misunderstanding how plans work or the risks involved can reduce their motivational impact.

- Valuation and Accounting

Determining the value of equity awards and accounting for them can be complicated, requiring specialized expertise.

- Market Volatility

Stock price fluctuations outside of employee control can impact the perceived value of equity awards, sometimes demotivating employees if stock prices decline.

- Dilution Concerns

Issuing new shares for equity awards dilutes existing shareholders’ ownership, which can be a concern for investors.

- Regulatory and Tax Implications

Equity compensation is subject to complex tax rules and securities regulations, requiring careful plan design and administration.

Best Practices for Implementing LTEIPs

- Design for Alignment

Structure awards to align employee incentives with shareholder interests and company strategic goals. Performance metrics should be clear and meaningful.

- Educate Employees

Provide comprehensive education to help employees understand the value, risks, and mechanics of equity awards to maximize their motivational effect.

- Use Vesting Schedules

Implement vesting schedules that encourage retention and sustained performance, such as four-year vesting with a one-year cliff.

- Consider Market Practices

Benchmark plans against industry standards to remain competitive while managing dilution and compensation costs.

- Regularly Review Plans

Continually assess plan effectiveness, employee engagement, and alignment with business objectives, adjusting as necessary.

Conclusion

Long Term Equity Incentive Plans play a critical role in modern compensation strategies by aligning employee interests with shareholder value and encouraging a focus on sustained company success. These plans help attract, motivate, and retain key talent by offering the opportunity to share in the company’s growth and profitability.

While LTEIPs come with challenges related to complexity, market volatility, and regulatory considerations, thoughtful design, clear communication, and ongoing management can maximize their benefits. By incorporating LTEIPs into their total rewards strategy, companies can foster a culture of ownership, drive long-term performance, and enhance their competitive position in the marketplace.

by Mark Morgenfruh | May 22, 2025 | Compensation Practices

Strategic compensation programs start with the Job Analysis. It is impossible to market price a position if you haven’t defined what the job does and what requirements for skills, education and experience someone needs to be successful in the job? We help every business in America

The Role of Job Analysis in a Structured Compensation Program: Purpose, Process, and Strategic Value

An effective compensation strategy starts with a deep understanding of what work is being done, how it contributes to the organization, and what skills and responsibilities are required to perform it. That’s where job analysis comes in.

Job analysis is the cornerstone of a structured compensation program. It provides the foundation for fair pay, internal equity, external competitiveness, and strategic workforce planning. Without it, compensation systems risk being inconsistent, subjective, and vulnerable to bias or legal risk.

In this article, we’ll explore:

- What job analysis is

- Its purpose within compensation systems

- The step-by-step process

- How it supports equity, transparency, and compliance

- Best practices for implementation

What Is Job Analysis?

Job analysis is the systematic process of gathering, documenting, and analyzing information about a job’s duties, responsibilities, necessary skills, outcomes, and work environment. It focuses on the job itself—not the person currently performing it.

The output of job analysis typically includes:

- Job descriptions

- Job specifications

- Job classification and evaluation data

This information forms the bedrock of structured compensation programs, recruitment efforts, performance management systems, and career pathing frameworks.

Purpose of Job Analysis in Compensation Programs

- Foundation for Internal Equity

Job analysis helps organizations ensure that employees are paid fairly in relation to others within the company by:

- Classifying roles into appropriate pay grades

- Distinguishing between similar-sounding jobs that have different scopes or impacts

- Preventing pay compression and favoritism

- Accurate Job Matching for Market Benchmarking

To compare compensation with the external market, you need to match internal jobs with survey jobs. Job analysis provides the detail needed to ensure accurate job matches in compensation surveys.

Without job analysis, organizations risk benchmarking roles incorrectly, leading to overpaying or underpaying.

- Legal Compliance

Regulatory bodies such as the EEOC, OFCCP, and Department of Labor require employers to maintain accurate records about job duties, qualifications, and compensation decisions.

Job analysis supports:

- Equal Pay Act compliance (justifying pay differences)

- FLSA classification (exempt vs. non-exempt)

- ADA accommodation planning

- Job Evaluation and Pay Structure Design

Job analysis provides the data for job evaluation systems (e.g., point factor, classification, ranking). These systems determine:

- A job’s relative value within the organization

- The appropriate placement in pay bands or grades

- The structure and spread of pay ranges

- Career Pathing and Development

By clearly documenting the duties and qualifications of each role, job analysis makes it possible to:

- Design career ladders and lattices

- Identify skill gaps and training needs

- Support succession planning

The Job Analysis Process: Step by Step

A rigorous job analysis process typically follows these structured phases:

Step 1: Planning and Preparation

- Identify the scope and purpose of the job analysis initiative.

- Decide which jobs will be analyzed (e.g., all jobs, job families, high-turnover roles).

- Communicate the goals to managers and employees to ensure buy-in.

Step 2: Data Collection

Gather information through a variety of methods:

- Employee questionnaires or surveys

- Job observation

- Interviews with job incumbents and supervisors

- Work diaries or logs

- Review of existing documents (org charts, previous job descriptions, performance reviews)

The goal is to capture:

- Key duties and tasks

- Tools and technology used

- Decision-making scope

- Supervisory responsibilities

- Physical, mental, and environmental demands

- Minimum education, experience, and skills

Step 3: Data Analysis and Documentation

- Organize the data into structured job descriptions that include:

- Job title

- Job summary

- Essential functions and responsibilities

- Required qualifications

- Reporting relationships

- Working conditions

- Highlight differences between similar roles to aid in job leveling

Step 4: Job Evaluation

Use the documented analysis to evaluate the job’s relative worth in the organization using a consistent methodology:

- Point-factor (assigning numerical values to compensable factors like complexity, scope, and impact)

- Market pricing

- Job classification systems

This helps determine where each job fits into the compensation structure.

Step 5: Review and Validation

- Validate the job descriptions and evaluations with supervisors and incumbents.

- Make adjustments based on feedback to ensure accuracy and fairness.

- Maintain records and establish a review cycle (e.g., every 1–2 years or when roles change significantly).

Strategic Benefits of Job Analysis in Compensation Programs

✅ Promotes Pay Transparency

Clearly defined jobs and pay levels give employees a better understanding of how compensation decisions are made, increasing trust and motivation.

✅ Supports Pay Equity and DEI

By focusing on the job—not the person—job analysis reduces subjectivity and helps companies:

- Identify unjustified pay gaps

- Defend pay decisions with evidence

- Design equitable career progression pathways

✅ Improves Talent Acquisition and Retention

Accurate job descriptions help:

- Attract the right candidates

- Set clear performance expectations

- Provide visibility into growth opportunities

✅ Aligns Compensation With Business Strategy

Understanding the work being done allows HR and leadership to:

- Identify critical roles

- Prioritize rewards for high-impact positions

- Allocate compensation budgets effectively

Common Pitfalls to Avoid

- Outdated Job Data: Job roles evolve. Stale job descriptions can lead to misaligned compensation.

- Vague Language: Avoid generic duties that don’t clearly describe responsibilities or impact.

- Confusing Jobs with People: A job analysis should reflect the role, not the unique capabilities or personalities of incumbents.

- Inconsistent Methods: Using different tools or standards for different roles undermines credibility and fairness.

- Ignoring Stakeholder Input: Excluding employees or managers leads to inaccurate or incomplete job profiles.

Best Practices

- Use structured templates for consistency across departments

- Establish a job architecture system (e.g., job families, levels, and grades)

- Keep job descriptions and analyses updated in response to organizational or market changes

- Integrate job analysis into onboarding, performance management, and workforce planning processes

- Train HR and managers on how to interpret and use job analysis in compensation decisions

Conclusion

A well-executed job analysis process is foundational to a structured compensation program. It enables organizations to reward employees fairly, comply with regulations, and build pay systems that are both equitable and strategic.

When you invest in understanding the work itself, you lay the groundwork for better compensation alignment, talent management, and business performance.

![]()