by Mark Morgenfruh | May 13, 2025 | Compensation Practices

Do you have to offer relocation assistance to a new hire? A current employee? How do you handle an office or facility move? We help every business in America

Current Practices in Employee Relocation Compensation: A Strategic Approach to Mobility

In today’s dynamic business environment, employee relocation is more common than ever—driven by talent acquisition strategies, organizational expansion, restructuring, or the shift to hybrid and distributed workforces. Relocation compensation programs have evolved beyond simple reimbursements, becoming more strategic, data-informed, and employee-centric.

This article explores current trends and best practices in employee relocation compensation, with a focus on three distinct scenarios:

- A newly-hired employee who needs to relocate

- A current employee being relocated for business needs

- A relocation of an entire office or facility

Each of these scenarios presents different challenges, expectations, and compensation models.

- Relocation Compensation for a Newly-Hired Employee

Overview:

When a new hire is recruited from a different geographic location, employers often offer a relocation package to ease the transition and improve offer acceptance. These packages are especially common for executive roles, highly specialized talent, or hard-to-fill positions.

Common Components:

Relocation support for new hires typically includes:

- House-hunting trip(s): Paid travel and lodging to explore neighborhoods and housing options before moving.

- Moving expenses: Full or partial reimbursement of packing, shipping, and transportation of household goods.

- Temporary housing: Hotel or short-term housing for 30–90 days.

- Travel costs: One-way travel (airfare, car rental, gas, etc.) for the employee and family.

- Home sale or lease break assistance: Support for selling a home or covering lease termination fees.

- Relocation bonus or lump sum: A one-time payment to cover incidental costs.

- Tax gross-up: Additional payment to cover tax liabilities on relocation-related compensation.

Current Trends:

- Lump-Sum Payments: Many companies are moving to lump-sum relocation programs, which offer flexibility and reduce administrative burden. However, these require clear communication about what the lump sum is intended to cover.

- Tiered Programs: Employers often implement tiered relocation policies based on job level, location, or family status. Executive-level moves may receive more comprehensive support.

- Relocation Allowances as Negotiable: In competitive labor markets, relocation benefits are increasingly treated as a negotiable part of the offer package.

Key Considerations:

- Cost containment: HR must balance attracting talent with managing relocation costs.

- Candidate experience: A seamless relocation experience strengthens the employer brand.

- Tax implications: Since the 2018 Tax Cuts and Jobs Act in the U.S., most employer-paid moving expenses are taxable, unless the employee is military.

- Relocation Compensation for a Current Employee

Overview:

Internal relocations often occur due to promotions, lateral moves, talent development programs, or operational needs. These moves are different from new hire relocations because the employee is already embedded in the company, with a proven track record and existing benefits.

Common Components:

- Moving expenses and travel costs (similar to new hire relocations)

- Temporary housing and storage of household goods

- Spousal job support or career counseling

- Cost-of-living adjustments (COLA) if relocating to a significantly more expensive area

- Retention bonuses or relocation stipends

- Children’s education support, if the employee has school-aged dependents

- Repatriation clause for international assignments, guaranteeing a return to a similar role post-assignment

Current Trends:

- Personalized Relocation Services: Internal moves are increasingly supported by relocation counselors or outsourced providers who manage logistics, timelines, and family needs.

- Dual-Career Assistance: Companies are recognizing the importance of spousal or partner employment support, including job search help or access to networks.

- Talent Mobility as Strategy: Organizations are using relocation as a career development tool, offering international or cross-regional moves to high-potential employees as part of succession planning.

Key Considerations:

- Transparency: Clear communication about what is covered (and what isn’t) prevents misunderstandings.

- Employee Retention: Relocations should be framed as opportunities, not obligations.

- Support after the move: Ongoing support for integration into the new role, culture, and community is critical to success.

- Compensation in Office or Facility Relocations

Overview:

When an entire office or facility is relocated—whether due to consolidation, expansion, or cost reduction—it can affect dozens or hundreds of employees. HR must manage the financial, legal, and human impacts simultaneously.

Common Compensation Practices:

- Retention bonuses: Offered to key employees who commit to staying until or beyond the relocation date.

- Relocation packages: Provided to employees asked to move with the facility, including moving costs, housing support, and COLA.

- Severance packages: For employees who do not or cannot relocate.

- Commuter subsidies: For employees who choose to commute rather than relocate.

- Outplacement services: Career coaching and job search support for those affected.

Current Trends:

- Voluntary Relocation Pools: Companies often survey employees to gauge willingness to relocate, allowing for better planning and cost management.

- Remote Work Alternatives: In light of hybrid and remote work trends, some employers offer remote roles instead of relocation, reducing the number of required moves.

- Phased Relocation: Rolling transitions help avoid business disruption and allow employees more time to plan.

Key Considerations:

- Legal compliance: WARN Act and other labor regulations may apply depending on the number of employees affected.

- Internal communication: Transparent, empathetic communication about reasons, timelines, and support is critical.

- Employee morale: Even employees not directly affected may feel uncertain or disengaged during facility relocations.

Strategic Best Practices Across All Scenarios

- Policy Standardization with Flexibility:

- Use consistent frameworks (e.g., tiered policies) while allowing for some discretion in high-priority cases.

- Relocation Vendors and Technology:

- Many companies partner with relocation service providers and use platforms to manage logistics, track costs, and enhance the employee experience.

- Global Mobility Integration:

- For multinational companies, relocation policies are aligned with global mobility programs, addressing immigration, tax, cultural training, and family support.

- Measurement and ROI:

- HR teams are increasingly using metrics like retention post-relocation, employee satisfaction, and relocation spend vs. business impact to evaluate program effectiveness.

- Equity and Inclusion:

- Companies are auditing relocation programs for accessibility and fairness, ensuring diverse employees receive equitable support regardless of background or family structure.

Conclusion

Employee relocation compensation is no longer a one-size-fits-all solution. Today’s employers must offer tailored, competitive, and compliant relocation support across a range of scenarios—from new hires to internal moves and large-scale facility shifts.

At its best, a strategic relocation program:

- Enhances employer brand

- Enables talent mobility

- Minimizes disruption

- Supports employee well-being

As business models evolve, especially in the era of hybrid and global work, relocation programs must keep pace—grounded in strategy, empathy, and agility.

by Mark Morgenfruh | May 13, 2025 | Compensation Practices

A cheeseburger in Manhattan, New York costs significantly more than one in Manhattan, Montana. Specialty skills are less likely to be widely available in rural areas. How do you know what to pay for a job in the geography where you operate? We help every business in America

Geographical Differentials in Compensation Practices

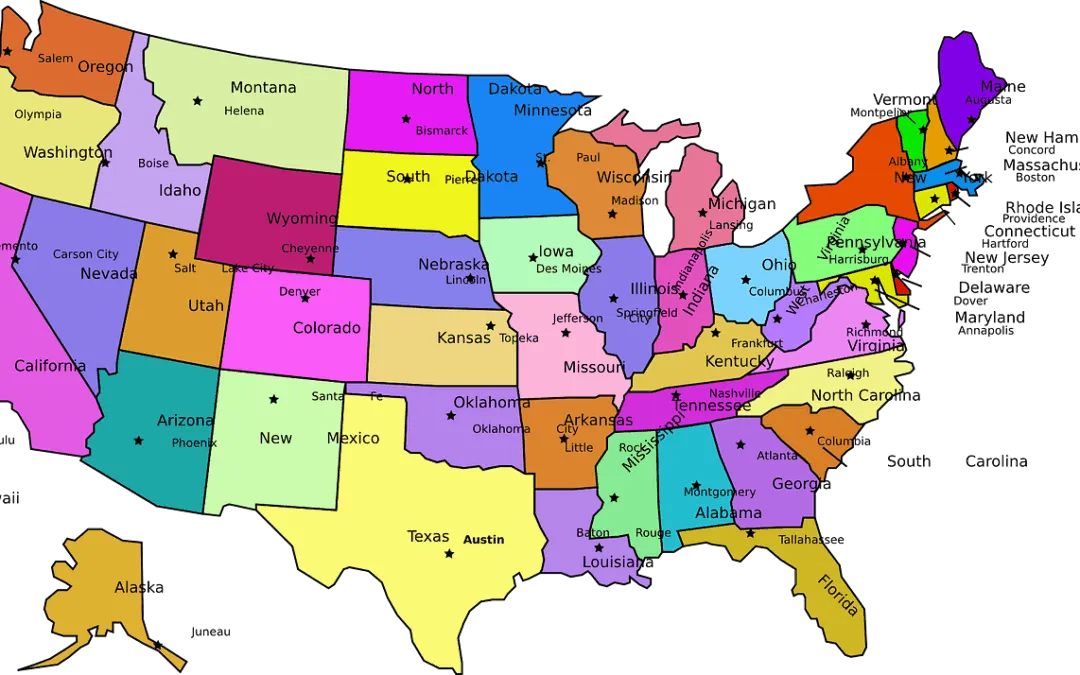

In today’s increasingly interconnected economy, compensation practices vary widely based on geography. Whether a business is managing employees across states, regions, or international borders, understanding geographical pay differentials is essential for maintaining equity, compliance, and competitiveness. Geographic location influences compensation due to differences in cost of living, labor supply and demand, regulatory environments, and market expectations. Companies that strategically apply these differentials can attract and retain talent while effectively managing labor costs.

What Are Geographical Pay Differentials?

Geographical pay differentials refer to adjustments in employee compensation based on the location where the work is performed. These adjustments account for variations in living costs, local wage norms, economic conditions, and industry competitiveness. For example, an entry-level marketing analyst in San Francisco may earn significantly more than a counterpart in Des Moines, Iowa, due to higher housing, transportation, and services costs in the Bay Area.

These differentials can apply to base pay, incentive pay, and even benefits. Organizations often use benchmark data from salary surveys and compensation databases to determine appropriate pay levels by location.

Key Drivers of Geographical Compensation Differences

- Cost of Living

One of the primary reasons for geographic pay variation is the cost of living. Employees in high-cost areas like New York City, San Francisco, or London face higher expenses for housing, groceries, transportation, and healthcare. To help maintain employee standards of living, employers often provide higher salaries in these locations. Cost-of-living indices and tools like the U.S. Bureau of Economic Analysis’s Regional Price Parities can guide these adjustments.

- Labor Market Conditions

Local labor market conditions influence compensation as well. High-demand skill sets or tight labor supply in a region can drive wages up. For example, tech hubs such as Seattle or Austin may command premium wages for software engineers due to intense competition among employers.

Conversely, areas with high unemployment or a surplus of talent may see lower wage growth, as the bargaining power of employees is reduced. Employers must stay attuned to labor market trends to remain competitive.

- Regional Business Costs

Operating costs for employers—like rent, utilities, and local taxes—can affect compensation decisions. In expensive urban centers, companies may increase compensation to retain employees who must cover their own increased living costs. Alternatively, companies may consider opening offices or hiring remotely in regions with more favorable cost structures.

- State and Local Laws

Minimum wage laws, overtime rules, pay equity regulations, and tax policies vary by jurisdiction. For instance, California’s minimum wage is higher than the federal minimum, requiring employers to comply with state-specific rules. Some cities, like Seattle and New York, also have their own pay transparency and wage floor laws. Employers must adjust pay practices to meet local legal standards while maintaining internal fairness.

- Remote and Hybrid Work Trends

The rise of remote work has added complexity to geographical compensation practices. Some companies, like Facebook and Google, have announced policies to adjust remote workers’ salaries based on their new locations, aligning pay with regional markets. Others have chosen to offer flat-rate compensation regardless of location, arguing that remote work is still equally valuable.

This evolving dynamic raises strategic questions: Should companies reward employees for moving to more affordable areas? Should pay reflect output rather than geography? The answers vary by company philosophy and talent strategy.

Strategic Approaches to Geographical Differentials

Organizations can choose from several models to manage geographic pay differences:

- National Pay Model: All employees are paid the same regardless of location. This is simpler to administer but may overpay in low-cost areas and underpay in high-cost ones.

- Local Market Pay Model: Compensation is aligned with local wage benchmarks. This is more precise but can introduce internal equity issues if employees in the same role are paid differently.

- Zone or Tiered Approach: Employees are grouped into geographic pay zones (e.g., Tier 1: major metros, Tier 2: suburbs, Tier 3: rural). This balances fairness with administrative efficiency.

- Custom Hybrid Models: Many employers combine elements, using national base pay with location-specific adjustments or stipends, especially for fully remote teams.

Challenges in Managing Pay Differentials

While strategic, geographic pay differentials come with risks:

- Perceived Inequity: Employees may feel undervalued if they earn less than peers in other regions for the same job.

- Communication Issues: Explaining pay differences requires clarity and transparency to maintain morale.

- Mobility Complications: When employees move—especially post-pandemic—companies must decide whether to adjust pay up or down, which can create friction.

- Regulatory Compliance: Staying current on wage laws across multiple jurisdictions can be resource-intensive.

Conclusion

Geographical differentials in compensation are an essential part of workforce strategy in today’s complex labor market. With rising mobility, remote work, and global expansion, businesses must balance cost control with talent competitiveness. The key is to build a fair, transparent, and data-driven approach that aligns pay with both external market realities and internal equity.

Ultimately, companies that thoughtfully manage geographic pay differences will be better positioned to attract, motivate, and retain top talent—no matter where that talent resides.

by Mark Morgenfruh | May 13, 2025 | HR Compliance, HR Audits, HR Handbooks, HR Hotlines, HR Leadership, HR On-Demand

On-demand Human Resources solutions solves for “I don’t need and can’t afford full-time HR,” but gives your company all the HR you’ll need until you’re large enough to hire an HR pro. And, let’s face it, even if you have HR, they could use some economical resources to make them more effective. We help every business in America

The Cost and Strategic Advantages of Having Good Human Resources Practices to Prevent Lawsuits Instead of Hiring Expensive Defense Attorneys

The traditional approach of many organizations to employment law compliance has been reactive, addressing legal challenges only after they arise and relying on expensive legal defense strategies to manage employment-related litigation. This approach represents a fundamental misunderstanding of both the economics and strategic implications of employment law risk management. Proactive human resources practices that prevent lawsuits offer dramatically superior cost-benefit profiles while delivering operational advantages that extend far beyond legal risk mitigation. Organizations that invest in comprehensive HR practices to prevent litigation consistently achieve better financial outcomes and operational performance than those that rely on post-incident legal defense strategies.

Dramatic Cost Differentials Between Prevention and Defense

The financial mathematics of employment law risk management strongly favor prevention over defense strategies. Employment litigation defense costs can easily reach hundreds of thousands or millions of dollars per case, with average defense costs ranging from $75,000 to $300,000 for routine employment disputes, while complex class-action cases can generate legal fees exceeding several million dollars. These costs include attorney fees, expert witness expenses, discovery costs, and internal resources devoted to litigation support, creating significant financial drains that can persist for years.

In contrast, comprehensive preventive HR practices typically require annual investments of tens of thousands of dollars for most organizations, even when including training programs, policy development, compliance auditing, and professional HR expertise. The cost differential is often 10:1 or greater when comparing prevention investments to single lawsuit defense costs, and the advantage becomes even more pronounced when considering the potential for multiple lawsuits or class-action scenarios.

The economic advantage of prevention becomes particularly compelling when considering the hidden costs of litigation that extend beyond legal fees. These include management time diverted from business operations, employee productivity losses due to disruption and distraction, potential damage to business relationships, and opportunity costs associated with resources that could have been invested in growth initiatives. A single significant employment lawsuit can consume hundreds of hours of senior management time, disrupting strategic initiatives and operational focus for months or years.

Settlement costs add another dimension to the financial analysis, as organizations often find that litigation defense costs can exceed eventual settlement amounts, creating situations where the cost of fighting exceeds the cost of resolving claims. Preventive HR practices eliminate both settlement exposure and defense costs, creating compound financial benefits that justify substantial prevention investments.

Operational Continuity and Business Focus

Employment litigation creates significant operational disruptions that can undermine business performance and strategic execution. When organizations face employment lawsuits, senior leadership attention becomes diverted from growth initiatives, customer relationships, and competitive strategy toward legal defense activities. This disruption can last for years, particularly in complex cases that involve extensive discovery, depositions, and trial preparation.

The operational impact extends beyond leadership distraction to include employee morale and productivity effects. Litigation creates uncertainty and anxiety throughout the organization, particularly when cases involve allegations of systemic discrimination, harassment, or other widespread employment violations. Employees may become reluctant to report legitimate concerns, collaborate effectively, or focus fully on their work responsibilities when they perceive the organization as legally vulnerable.

Preventive HR practices create stable operational environments where employees and management can focus on business objectives rather than legal risks. Clear policies, consistent enforcement, and proactive problem-solving create workplace cultures where issues are addressed before they escalate to litigation, enabling sustained focus on business performance and strategic execution.

The continuity advantages extend to customer relationships and market positioning, as employment litigation can create reputational risks that affect business development and competitive positioning. Organizations known for strong employment practices enjoy competitive advantages in customer relationships, vendor partnerships, and market credibility that can translate into tangible business benefits.

Proactive Risk Identification and Mitigation

Effective preventive HR practices include systematic risk identification and mitigation processes that address potential problems before they become legal exposures. These practices include regular policy reviews, compliance auditing, employee feedback mechanisms, and trend analysis that identify emerging issues before they escalate to litigation.

This proactive approach enables organizations to address root causes of employment disputes rather than merely responding to symptoms after problems have become legal claims. For example, systematic analysis of exit interview data, employee survey results, and performance management trends can identify potential discrimination, harassment, or wage and hour issues before they result in formal complaints or lawsuits.

The risk mitigation benefits extend beyond legal compliance to include operational improvements that enhance business performance. Many employment law violations stem from operational inefficiencies, unclear communication, or inadequate management training that also contribute to broader business problems. Addressing these issues through preventive HR practices creates both legal protection and operational improvements that deliver compound benefits.

Preventive practices also enable organizations to stay ahead of evolving legal requirements and industry standards, ensuring continued compliance as laws and regulations change. This forward-looking approach is particularly valuable in rapidly evolving areas such as wage and hour regulations, workplace safety requirements, and employment discrimination standards.

Enhanced Organizational Culture and Employee Relations

Strong preventive HR practices create positive organizational cultures that reduce the likelihood of employment disputes while enhancing employee engagement, retention, and performance. These practices demonstrate organizational commitment to fair treatment, clear communication, and respectful workplace relationships that build trust and loyalty among employees.

The culture benefits extend beyond legal risk reduction to include improved collaboration, innovation, and performance outcomes. Organizations with strong employment practices typically experience higher employee satisfaction, lower turnover rates, and better business results than those with weak or reactive approaches to employment law compliance.

Preventive practices also create positive feedback loops where good employment practices reinforce themselves through improved employee relations and organizational reputation. Employees who feel fairly treated and respected are more likely to resolve concerns internally rather than pursuing external legal remedies, creating self-reinforcing cycles of positive workplace relationships.

The cultural advantages include enhanced ability to attract and retain top talent, as organizations with strong employment practices develop reputations as preferred employers. This talent advantage can translate into competitive benefits that justify prevention investments through improved business performance and market positioning.

Regulatory Compliance and Relationship Management

Preventive HR practices help organizations maintain positive relationships with regulatory agencies and employment law enforcement bodies, creating advantages that extend beyond individual compliance issues. Organizations with strong preventive practices typically experience fewer regulatory investigations, more cooperative relationships with enforcement agencies, and more favorable outcomes when regulatory issues do arise.

These regulatory advantages can be particularly valuable during industry-wide investigations or compliance sweeps where organizations with strong practices may receive less scrutiny or more favorable treatment than those with weak compliance records. The regulatory benefits also include reduced likelihood of pattern or practice investigations that can result in significant penalties and ongoing compliance monitoring requirements.

Preventive practices also enable organizations to demonstrate good faith compliance efforts that can influence regulatory and judicial outcomes when issues do arise. Organizations with documented compliance programs, training records, and corrective action histories are often viewed more favorably by regulators and courts than those without such evidence of prevention efforts.

Competitive Advantage Through Reputation Management

Employment litigation can create significant reputational risks that affect customer relationships, business development opportunities, and competitive positioning. High-profile employment cases can generate negative media coverage, social media criticism, and market perception problems that persist long after legal cases are resolved.

Preventive HR practices help organizations avoid reputational risks while building positive employer brands that attract talent and enhance business relationships. Organizations known for strong employment practices often enjoy competitive advantages in customer relationships, vendor partnerships, and market credibility that translate into tangible business benefits.

The reputation advantages extend to investor relations and capital market positioning, as employment litigation can create concerns about management effectiveness, operational stability, and legal risk exposure that affect business valuations and investment attractiveness. Organizations with strong preventive practices typically experience better investor relations and capital market positioning.

Strategic Resource Allocation and Investment Optimization

The cost advantages of preventive HR practices enable organizations to allocate resources more strategically toward growth initiatives rather than legal defense activities. Resources devoted to prevention investments typically generate positive returns through improved operations, enhanced compliance, and reduced legal risks, while litigation defense costs represent pure expense without corresponding business benefits.

This resource allocation advantage becomes particularly significant over time, as organizations with strong preventive practices can invest litigation defense budgets in business development, innovation, and competitive positioning initiatives that generate sustainable advantages. The compound benefits of this strategic resource allocation can create substantial competitive advantages over organizations that rely on reactive legal defense strategies.

Preventive practices also enable more predictable budgeting and financial planning, as prevention costs are typically stable and plannable while litigation defense costs are unpredictable and can create significant financial disruptions. This predictability enables better strategic planning and resource allocation across all business functions.

Long-term Business Sustainability and Growth

Perhaps most importantly, preventive HR practices contribute to long-term business sustainability and growth by creating stable operational environments that support strategic execution and competitive performance. Organizations that invest in prevention typically experience fewer operational disruptions, better employee relations, and stronger market positioning that enable sustained growth and competitive success.

The sustainability advantages extend to leadership development and organizational capability building, as preventive practices create learning environments where management develops stronger employment law knowledge and human resources expertise. This capability building creates lasting competitive advantages that continue to generate benefits over time.

Preventive practices also support business scalability by creating HR systems and processes that can accommodate growth without creating additional legal risks. Organizations with strong preventive practices can expand operations, enter new markets, and acquire other businesses with confidence that their employment practices will support rather than constrain growth initiatives.

The evidence overwhelmingly supports the strategic and financial advantages of investing in preventive HR practices rather than relying on reactive legal defense strategies. Organizations that embrace this proactive approach consistently achieve better financial outcomes, operational performance, and competitive positioning while avoiding the significant costs and disruptions associated with employment litigation. The investment in prevention represents one of the highest-return strategic investments available to modern organizations, delivering benefits that extend far beyond legal risk mitigation to include enhanced competitive advantage and sustainable business success.

by Mark Morgenfruh | May 13, 2025 | Private Equity & HR

Why did your deal end up failing? You bought a firm that had horrible employee engagement and people left after the closing because they were fed up being worked to the bone? The Seller cut staff and overworked those who remained to make the bottom line look better? The target company grossly underpaid their employees and post close you have a line out your door for pay raises to the tune of $250k? $500k? And, their requests are legitimate! We help every business in America

What Private Equity Firms Risk by Overlooking the Due Diligence of Human Capital

Private equity firms have traditionally focused their due diligence efforts on financial performance, market dynamics, and operational metrics, often treating human capital as a secondary consideration. This approach carries significant risks that can fundamentally undermine investment returns and create unexpected challenges throughout the ownership period. As the economy increasingly shifts toward knowledge-based industries and talent-dependent business models, the consequences of inadequate human capital due diligence have become more severe and far-reaching, threatening the very foundation of value creation strategies.

Catastrophic Key Person Risk and Leadership Vulnerability

The most immediate and potentially devastating risk of inadequate human capital due diligence is the loss of critical talent shortly after acquisition. Many private equity firms have learned this lesson the hard way when key executives, technical experts, or customer relationship managers departed following ownership changes, taking with them institutional knowledge, client relationships, and competitive advantages that were fundamental to the investment thesis.

This risk is particularly acute in service-based businesses, technology companies, and organizations where specific expertise or relationships drive revenue generation. When due diligence fails to identify these dependencies or assess the likelihood of key person retention, private equity firms may find themselves owning businesses that are shadows of their former selves. The departure of a single critical individual can trigger cascading effects, including client defections, project delays, competitive disadvantages, and team demoralization that collectively destroy value far exceeding the original investment assumptions.

Key person risk extends beyond immediate departures to include succession planning failures and leadership development gaps. Organizations that appear strong on the surface may lack depth in critical roles, creating vulnerabilities that become apparent only under the stress of ownership transition or growth initiatives. Without proper assessment of leadership bench strength and development capabilities, private equity firms may find themselves unable to scale operations or execute strategic initiatives effectively.

Hidden Employment Liabilities and Legal Exposures

Inadequate human capital due diligence frequently fails to uncover significant employment-related liabilities that can result in costly litigation, regulatory penalties, and reputational damage. These hidden exposures include wage and hour violations, discrimination claims, harassment allegations, and compliance failures that may not surface until after acquisition when the private equity firm becomes responsible for addressing them.

The financial impact of these liabilities can be substantial, with employment-related settlements often reaching millions of dollars, particularly in class-action situations involving wage and hour violations or systemic discrimination. Beyond direct financial costs, these issues can consume significant management attention, delay strategic initiatives, and damage relationships with employees, customers, and other stakeholders.

Compliance failures in areas such as worker classification, overtime calculations, and benefits administration can result in government investigations and penalties that extend far beyond the original violation. Private equity firms that fail to identify these issues during due diligence may find themselves facing regulatory scrutiny and enforcement actions that create ongoing operational challenges and financial burdens throughout the investment period.

Cultural Misalignment and Integration Failures

Private equity firms often underestimate the critical importance of organizational culture in driving performance and enabling successful transformation initiatives. When human capital due diligence fails to assess cultural dynamics, values alignment, and change readiness, the resulting cultural misalignment can create insurmountable obstacles to value creation efforts.

Cultural integration failures are particularly common in situations involving multiple acquisitions, roll-up strategies, or significant operational changes. Different organizational cultures may conflict in ways that prevent effective collaboration, knowledge sharing, and strategic alignment. These conflicts can manifest as reduced productivity, increased turnover, poor customer service, and resistance to improvement initiatives that are essential for achieving investment returns.

The risk is compounded when private equity firms impose operational changes or performance expectations that are fundamentally inconsistent with the existing organizational culture. Without understanding the cultural context and change capacity of the target organization, well-intentioned improvement initiatives may backfire, creating employee disengagement and performance deterioration rather than the expected enhancements.

Workforce Capability Gaps and Scalability Limitations

Many private equity investment strategies depend on significant growth and operational scaling that requires workforce capabilities not present in the target organization at the time of acquisition. Inadequate human capital due diligence may fail to identify these capability gaps, leaving private equity firms unprepared to execute their growth strategies effectively.

These gaps can include technical skills shortages, leadership development needs, process improvement capabilities, and change management expertise. When these deficiencies are not identified during due diligence, private equity firms may find themselves unable to implement planned initiatives or may need to invest significantly more time and resources than anticipated to build necessary capabilities.

The challenge is particularly acute in rapidly growing markets or technology-driven industries where specific skills are scarce and expensive to acquire. Private equity firms that fail to assess workforce capabilities adequately may discover that their growth plans are constrained by talent availability, requiring substantial additional investment in recruitment, training, and development that was not factored into original return calculations.

Compensation and Benefits Misalignment

Inadequate assessment of compensation and benefits structures can create significant financial exposure and operational challenges that threaten investment returns. Many private equity firms discover after acquisition that existing compensation arrangements are not aligned with performance expectations, market conditions, or growth objectives, requiring costly adjustments that were not anticipated in the original investment model.

Overly generous compensation arrangements may create unsustainable cost structures that prevent the achievement of profitability targets, while inadequate compensation may result in talent retention challenges and recruitment difficulties. Similarly, benefits obligations such as pension liabilities, deferred compensation arrangements, and equity-based compensation can create significant financial commitments that extend well beyond the planned investment horizon.

The risk is compounded when compensation structures create incentives that are misaligned with private equity value creation objectives. For example, compensation arrangements that reward revenue growth without regard to profitability may prevent the implementation of operational improvements that are essential for achieving target returns.

Operational Execution and Change Management Failures

Private equity value creation typically requires significant operational changes, process improvements, and strategic initiatives that depend heavily on workforce capability and engagement. Inadequate human capital due diligence may fail to assess the organization’s capacity for executing these changes effectively, leading to implementation failures that prevent the achievement of investment objectives.

Change management capability is particularly critical in private equity environments where transformation timelines are compressed and performance expectations are high. Organizations that lack change management expertise, employee engagement, or leadership capability may struggle to implement even well-designed improvement initiatives, resulting in wasted resources and missed opportunities for value creation.

The risk extends to basic operational execution capabilities, including project management, process improvement, and performance monitoring. Private equity firms that fail to assess these capabilities during due diligence may find themselves unable to implement planned improvements or may need to invest significantly in capability building before transformation initiatives can be successful.

Technology and Digital Transformation Limitations

Modern private equity value creation increasingly depends on technology optimization and digital transformation initiatives that require specific workforce capabilities and change readiness. Inadequate human capital due diligence may fail to assess whether the organization has the skills, culture, and leadership necessary to execute these technology-driven improvements successfully.

Digital transformation initiatives often fail due to workforce resistance, skills gaps, or inadequate change management rather than technical challenges. Private equity firms that overlook these human factors during due diligence may find their technology investments delivering limited returns or creating operational disruptions that offset expected benefits.

The challenge is particularly acute when technology initiatives require significant changes to job roles, processes, or organizational structures. Without proper assessment of workforce adaptability and change readiness, private equity firms may discover that their digital transformation strategies are constrained by human capital limitations that were not identified during the investment evaluation process.

Exit Strategy Constraints and Valuation Impact

The ultimate success of private equity investments depends on successful exits that deliver attractive returns to investors. Inadequate human capital due diligence can create constraints on exit strategies and negatively impact valuations in ways that may not become apparent until the exit process begins.

Potential acquirers and public market investors increasingly focus on human capital strength as a key indicator of business sustainability and growth potential. Organizations with weak leadership, cultural challenges, or talent retention issues may be viewed as higher risk investments, resulting in lower valuations or limited exit options that constrain private equity returns.

The risk is particularly significant when exit strategies depend on management buyouts or leadership transitions. If key personnel lack the capability or commitment necessary to support these transitions, private equity firms may find their exit options severely limited, forcing them to hold investments longer than planned or accept lower returns than anticipated.

Systemic Value Destruction Through Neglect

Perhaps the most insidious risk of inadequate human capital due diligence is the gradual erosion of organizational capability and performance that occurs when human capital issues are not properly addressed. This value destruction may not be immediately apparent but can accumulate over time, ultimately preventing the achievement of investment objectives and reducing exit values.

Neglecting human capital due diligence sends a message to the organization that people are not valued, which can lead to reduced engagement, increased turnover, and declining performance. This creates a negative spiral where talented employees leave, organizational capability deteriorates, and business performance suffers, making it increasingly difficult to achieve the improvements necessary for investment success.

The long-term consequences of this neglect can be severe, including the loss of competitive advantages, customer relationships, and market position that were fundamental to the original investment thesis. Private equity firms that fail to recognize and address these risks may find themselves owning businesses that are worth significantly less than their original investment, regardless of market conditions or industry performance.

Conculsion

The risks associated with inadequate human capital due diligence in private equity are both immediate and far-reaching, affecting every aspect of the investment lifecycle from initial value creation through eventual exit. These risks have become increasingly critical as the economy has shifted toward knowledge-based industries and talent-dependent business models. Private equity firms that continue to treat human capital as a secondary consideration do so at their own peril, exposing themselves to preventable failures that can fundamentally undermine investment returns and damage their reputation in the market.

by Mark Morgenfruh | May 12, 2025 | Strategic Compensation

Do you really know if you’re paying your people competitively? In a world of rapidly-changing variables within Total Rewards packages, base pay and annual incentives remain the foundation. It’s remarkably easy and incredibly important to get right. Or, you can always find out after your top performers leave.

We help every business in America

How a Company’s Compensation Philosophy and Practices Differ by the Company’s Stage of Development

Compensation philosophy and practices are critical components of an organization’s overall human resources strategy. They reflect how a company values its people, motivates performance, attracts talent, and manages costs. However, a company’s approach to compensation is not static. It evolves significantly as the company moves through different stages of development—from startup, to growth, to maturity, and sometimes decline or renewal.

This article explores how compensation philosophies and practices vary across these stages, why those differences matter, and what companies should consider when designing pay programs tailored to their stage of development.

Understanding Compensation Philosophy and Practices

Compensation Philosophy is the set of guiding principles that shape how a company designs and administers employee pay. It answers questions such as:

- What is the company’s stance on pay competitiveness? (e.g., lead the market, match, or lag)

- How does the company balance fixed pay (salary) versus variable pay (bonuses, commissions)?

- What role does equity or long-term incentives play?

- How important is internal equity versus external market alignment?

Compensation Practices are the concrete policies and procedures used to implement the philosophy, including:

- Pay structures and salary ranges

- Bonus and incentive programs

- Equity grants and stock options

- Benefits packages

- Pay review cycles and merit increases

These philosophies and practices must be aligned with the company’s business objectives, culture, and importantly, its stage of development.

Company Stages of Development

The lifecycle of most companies typically includes:

- Startup Stage

- Growth Stage

- Maturity Stage

- Renewal or Decline Stage

Each stage has unique challenges, priorities, and resource constraints that influence compensation approaches.

- Compensation Philosophy and Practices in the Startup Stage

Characteristics of the Startup Stage

- Limited financial resources, often negative cash flow

- High risk and uncertainty

- Small teams, fluid roles, and evolving organizational structure

- Focus on innovation, product development, and market validation

- Often founder-led with informal management systems

Compensation Philosophy in Startups

In startups, compensation philosophy tends to emphasize:

- Equity as a primary motivator: Since cash is limited, startups commonly offer equity stakes (stock options or restricted stock units) to align employee interests with company success and long-term value creation.

- Below-market base pay: Startups often pay less than established competitors in salary to conserve cash.

- High value on flexibility and culture: Pay is less standardized and more negotiable; the culture may emphasize mission, impact, and ownership.

- Focus on attracting entrepreneurial talent: Employees willing to accept risk for potential high reward.

Compensation Practices in Startups

- Small or no formal salary bands: Compensation is often decided on a case-by-case basis.

- Equity grants with vesting: Stock options with 4-year vesting schedules are common.

- Variable pay is limited or informal: Bonuses are rare due to cash constraints.

- Informal benefits: Perks like flexible hours, remote work, or casual work environments often substitute for formal benefits.

- Rapid adjustment: Compensation packages may change frequently as the company pivots or secures funding.

Challenges

- Balancing cash constraints with the need to attract talent

- Communicating the value and risks of equity compensation clearly

- Avoiding underpayment that leads to turnover

- Compensation Philosophy and Practices in the Growth Stage

Characteristics of the Growth Stage

- Increasing revenues and improving cash flow

- Rapid expansion of teams and markets

- Building formal management and HR systems

- Greater competition for talent

- More pressure on operational efficiency and scaling

Compensation Philosophy in Growth Companies

- Market competitiveness becomes more important: To attract and retain growing numbers of employees, companies move toward paying at or near market rates.

- Balanced mix of cash and equity: While equity remains important, cash compensation grows to competitive levels.

- Incentivizing performance and retention: Bonus and incentive programs are developed to reward individual and company achievements.

- Building consistent policies: Startups begin formalizing salary ranges, job grades, and compensation structures.

- Aligning pay with strategy: Compensation supports scaling goals, customer acquisition, and operational excellence.

Compensation Practices in Growth Companies

- Introduction of structured salary bands: Salary ranges linked to job roles and levels emerge.

- Formal performance management: Merit increases tied to reviews and goal achievement.

- Broader use of bonuses: Performance bonuses, spot awards, and commissions for sales roles.

- Expanded benefits offerings: Health insurance, retirement plans, and wellness programs to compete with other employers.

- More systematic equity plans: Stock options or restricted stock units remain but with clearer policies and communication.

- Use of HR and compensation data systems: Technology is adopted for payroll, tracking, and analytics.

Challenges

- Managing rapid headcount growth while controlling costs

- Ensuring internal equity as roles diversify

- Communicating pay philosophy clearly to a more diverse workforce

- Compensation Philosophy and Practices in the Maturity Stage

Characteristics of Mature Companies

- Stable revenues and profits

- Established market position

- Larger workforce with diverse roles and geographies

- Formalized policies and governance structures

- Increasing regulatory and compliance requirements

Compensation Philosophy in Mature Companies

- Focus on internal equity and fairness: Mature companies emphasize fairness and transparency in compensation decisions.

- Lead or match market pay: To retain key talent and reduce turnover, mature firms often target market median or above.

- Pay for performance: Structured merit increases and incentive plans link pay closely to individual, team, and company results.

- Comprehensive total rewards: Pay is one part of a broad rewards strategy including benefits, career development, and work-life balance.

- Emphasis on governance and compliance: Compensation decisions follow formal policies reviewed by leadership and sometimes boards.

Compensation Practices in Mature Companies

- Detailed salary structures and job leveling: Well-defined pay grades with clear criteria for progression.

- Robust performance management systems: Formal review cycles with calibration to ensure consistency.

- Diverse incentive programs: Bonuses, long-term incentives (stock awards), and profit-sharing plans.

- Global compensation strategies: For multinational firms, pay practices address local markets and regulations.

- Comprehensive benefits: Health, retirement, wellness, employee assistance, and other perks.

- Transparency and communication: Employee handbooks, portals, and training to explain pay philosophy and policies.

Challenges

- Balancing cost control with competitive pay demands

- Managing complexity across large, diverse workforces

- Avoiding complacency and fostering engagement through compensation

- Compensation Philosophy and Practices in Renewal or Decline Stage

Characteristics of Renewal or Decline Stage

- Market challenges or financial pressures

- Need for restructuring or turnaround strategies

- Possible workforce reductions or changes in business focus

- Increased scrutiny on cost management

Compensation Philosophy in Renewal or Decline

- Cost containment priority: Pay increases may be frozen or minimized.

- Focus on critical roles: Compensation is prioritized for roles essential to turnaround or transformation.

- Increased use of variable pay: Incentives tied to turnaround milestones.

- Retention focus: Special retention bonuses or equity grants for key employees.

- Re-evaluating total rewards: Possible reduction in benefits or perks balanced with efforts to maintain morale.

Compensation Practices in Renewal or Decline

- Salary freezes or reductions: Common to manage costs.

- Retention bonuses: Targeted to critical talent to avoid brain drain.

- Revised incentive plans: To drive turnaround goals or cost savings.

- Clear communication: Transparency about compensation constraints to maintain trust.

- Selective recruitment: Limited hiring with competitive pay only for essential roles.

Challenges

- Maintaining employee morale amidst pay constraints

- Retaining key talent during uncertain times

- Managing legal risks in layoffs or pay reductions

Why Compensation Philosophy Must Evolve with Company Stage

Attracting and Retaining Talent

- Startups must rely on equity and culture to attract risk-tolerant innovators.

- Growth firms compete for skilled professionals with cash and benefits.

- Mature companies focus on fairness and career growth.

- Renewal-stage firms prioritize retention amid constraints.

Aligning Pay with Business Priorities

- Startups reward innovation and long-term potential.

- Growth companies incentivize scale and execution.

- Mature companies emphasize steady performance.

- Declining firms focus on survival and transformation.

Managing Financial Realities

- Startups face cash scarcity.

- Growth firms balance investment with control.

- Mature firms manage large payrolls efficiently.

- Renewal-stage companies must cut costs carefully.

Practical Recommendations for Companies

- Assess and document your current compensation philosophy.

- Ensure compensation aligns with your business goals and stage.

- Communicate clearly and frequently with employees about pay.

- Regularly review and adjust compensation practices as you evolve.

- Invest in systems and expertise appropriate for your size and complexity.

- Engage leadership and governance bodies in compensation oversight.

Conclusion

A company’s compensation philosophy and practices are not one-size-fits-all; they must be tailored to the company’s stage of development. From the equity-heavy, flexible approaches of startups to the structured, performance-driven models of mature firms, compensation strategies must evolve to reflect changing priorities, financial realities, and workforce expectations.

Understanding these differences helps companies create effective compensation programs that attract and retain the right talent, support strategic goals, and manage costs—ultimately driving sustainable business success at every stage of growth.

![]()